While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and optimism towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the first quarter and hedging or reducing many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding The Geo Group, Inc. (NYSE:GEO).

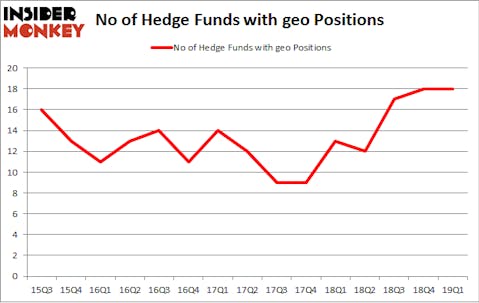

The Geo Group, Inc. (NYSE:GEO) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 18 hedge funds’ portfolios at the end of March. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as GreenSky, Inc. (NASDAQ:GSKY), Albany International Corp. (NYSE:AIN), and Oi SA (NYSE:OIBR) to gather more data points.

In today’s marketplace there are tons of metrics stock traders can use to assess publicly traded companies. Some of the most underrated metrics are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the top picks of the elite fund managers can trounce the broader indices by a solid amount (see the details here).

We’re going to view the recent hedge fund action surrounding The Geo Group, Inc. (NYSE:GEO).

What does the smart money think about The Geo Group, Inc. (NYSE:GEO)?

At the end of the first quarter, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GEO over the last 15 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Capital Growth Management, managed by Ken Heebner, holds the number one position in The Geo Group, Inc. (NYSE:GEO). Capital Growth Management has a $31.9 million position in the stock, comprising 2% of its 13F portfolio. Sitting at the No. 2 spot is Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, which holds a $24.6 million position; 0.1% of its 13F portfolio is allocated to the stock. Other members of the smart money that hold long positions include David Harding’s Winton Capital Management, Ken Griffin’s Citadel Investment Group and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Judging by the fact that The Geo Group, Inc. (NYSE:GEO) has experienced a decline in interest from hedge fund managers, we can see that there lies a certain “tier” of fund managers who were dropping their full holdings last quarter. Interestingly, Minhua Zhang’s Weld Capital Management dumped the largest investment of all the hedgies watched by Insider Monkey, worth close to $1.5 million in stock. Peter Algert and Kevin Coldiron’s fund, Algert Coldiron Investors, also said goodbye to its stock, about $0.6 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as The Geo Group, Inc. (NYSE:GEO) but similarly valued. These stocks are GreenSky, Inc. (NASDAQ:GSKY), Albany International Corp. (NYSE:AIN), Oi SA (NYSE:OIBR), and Acacia Communications, Inc. (NASDAQ:ACIA). All of these stocks’ market caps are closest to GEO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GSKY | 15 | 68872 | -5 |

| AIN | 16 | 87031 | 5 |

| OIBR | 21 | 826627 | 0 |

| ACIA | 31 | 319611 | 11 |

| Average | 20.75 | 325535 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $326 million. That figure was $117 million in GEO’s case. Acacia Communications, Inc. (NASDAQ:ACIA) is the most popular stock in this table. On the other hand GreenSky, Inc. (NASDAQ:GSKY) is the least popular one with only 15 bullish hedge fund positions. The Geo Group, Inc. (NYSE:GEO) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on GEO as the stock returned 15.4% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.