We at Insider Monkey have gone over 730 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of June 28th. In this article, we look at what those funds think of Smith & Nephew plc (NYSE:SNN) based on that data.

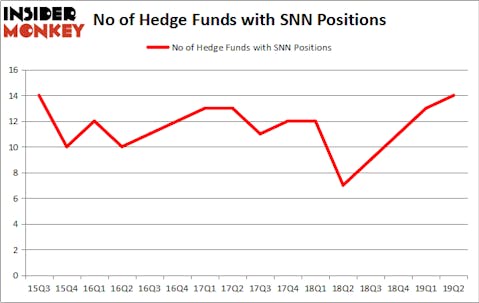

Smith & Nephew plc (NYSE:SNN) has experienced an increase in hedge fund interest lately. SNN was in 14 hedge funds’ portfolios at the end of June. There were 13 hedge funds in our database with SNN positions at the end of the previous quarter. Our calculations also showed that SNN isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are many tools shareholders employ to value their holdings. A pair of the most underrated tools are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the elite investment managers can beat their index-focused peers by a healthy margin (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s go over the recent hedge fund action surrounding Smith & Nephew plc (NYSE:SNN).

How have hedgies been trading Smith & Nephew plc (NYSE:SNN)?

At Q2’s end, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of 8% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SNN over the last 16 quarters. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

More specifically, Arrowstreet Capital was the largest shareholder of Smith & Nephew plc (NYSE:SNN), with a stake worth $136.7 million reported as of the end of March. Trailing Arrowstreet Capital was Iridian Asset Management, which amassed a stake valued at $114.9 million. Millennium Management, Pura Vida Investments, and Renaissance Technologies were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key money managers have jumped into Smith & Nephew plc (NYSE:SNN) headfirst. Iridian Asset Management, managed by David Cohen and Harold Levy, initiated the most valuable position in Smith & Nephew plc (NYSE:SNN). Iridian Asset Management had $114.9 million invested in the company at the end of the quarter. Efrem Kamen’s Pura Vida Investments also made a $10.9 million investment in the stock during the quarter. The other funds with brand new SNN positions are Steve Cohen’s Point72 Asset Management and Michael Gelband’s ExodusPoint Capital.

Let’s also examine hedge fund activity in other stocks similar to Smith & Nephew plc (NYSE:SNN). We will take a look at Liberty Broadband Corp (NASDAQ:LBRDK), CBS Corporation (NYSE:CBS), Hess Corporation (NYSE:HES), and Ctrip.com International, Ltd. (NASDAQ:CTRP). This group of stocks’ market caps are closest to SNN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LBRDK | 40 | 3455587 | 1 |

| CBS | 50 | 1708960 | 4 |

| HES | 35 | 1575949 | 6 |

| CTRP | 27 | 1153907 | -2 |

| Average | 38 | 1973601 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38 hedge funds with bullish positions and the average amount invested in these stocks was $1974 million. That figure was $319 million in SNN’s case. CBS Corporation (NYSE:CBS) is the most popular stock in this table. On the other hand Ctrip.com International, Ltd. (NASDAQ:CTRP) is the least popular one with only 27 bullish hedge fund positions. Compared to these stocks Smith & Nephew plc (NYSE:SNN) is even less popular than CTRP. Hedge funds clearly dropped the ball on SNN as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on SNN as the stock returned 10.5% during the third quarter and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.