Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index ETF (SPY) lost 13.5% in the fourth quarter. Seven out of 11 industry groups in the S&P 500 Index were down more than 20% from their 52-week highs at the trough of the stock market crash. The average return of a randomly picked stock in the index was even worse. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 15 most popular S&P 500 stocks among hedge funds not only recouped their Q4 losses but also outperformed the index by more than 3 percentage points. In this article, we will take a look at what hedge funds think about Sibanye Gold Ltd (NYSE:SBGL).

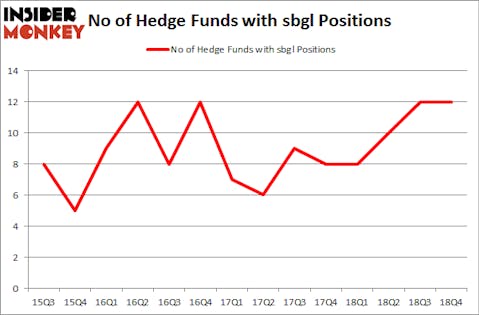

Sibanye Gold Ltd (NYSE:SBGL) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 12 hedge funds’ portfolios at the end of the fourth quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Forward Air Corporation (NASDAQ:FWRD), Universal Forest Products, Inc. (NASDAQ:UFPI), and Dillard’s, Inc. (NYSE:DDS) to gather more data points.

In the eyes of most traders, hedge funds are assumed to be worthless, outdated financial vehicles of the past. While there are greater than 8000 funds in operation at present, Our experts look at the masters of this club, around 750 funds. These investment experts have their hands on bulk of all hedge funds’ total asset base, and by tailing their inimitable picks, Insider Monkey has brought to light many investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a gander at the latest hedge fund action surrounding Sibanye Gold Ltd (NYSE:SBGL).

What have hedge funds been doing with Sibanye Gold Ltd (NYSE:SBGL)?

Heading into the first quarter of 2019, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the second quarter of 2018. By comparison, 8 hedge funds held shares or bullish call options in SBGL a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Sibanye Gold Ltd (NYSE:SBGL) was held by Millennium Management, which reported holding $14.1 million worth of stock at the end of December. It was followed by D E Shaw with a $9.4 million position. Other investors bullish on the company included Renaissance Technologies, BlueCrest Capital Mgmt., and GLG Partners.

Because Sibanye Gold Ltd (NYSE:SBGL) has faced declining sentiment from the aggregate hedge fund industry, logic holds that there is a sect of money managers that decided to sell off their entire stakes in the third quarter. Intriguingly, Cliff Asness’s AQR Capital Management dropped the biggest stake of the 700 funds followed by Insider Monkey, comprising about $0.3 million in stock. Paul Tudor Jones’s fund, Tudor Investment Corp, also cut its stock, about $0 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Sibanye Gold Ltd (NYSE:SBGL) but similarly valued. These stocks are Forward Air Corporation (NASDAQ:FWRD), Universal Forest Products, Inc. (NASDAQ:UFPI), Dillard’s, Inc. (NYSE:DDS), and Prestige Consumer Healthcare Inc. (NYSE:PBH). All of these stocks’ market caps match SBGL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FWRD | 11 | 69939 | -4 |

| UFPI | 16 | 43942 | -2 |

| DDS | 14 | 102725 | -2 |

| PBH | 15 | 72873 | 1 |

| Average | 14 | 72370 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $72 million. That figure was $37 million in SBGL’s case. Universal Forest Products, Inc. (NASDAQ:UFPI) is the most popular stock in this table. On the other hand Forward Air Corporation (NASDAQ:FWRD) is the least popular one with only 11 bullish hedge fund positions. Sibanye Gold Ltd (NYSE:SBGL) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on SBGL as the stock returned 43.5% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.