Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Things completely reversed during the first half of 2019. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Roku, Inc. (NASDAQ:ROKU) to find out whether it was one of their high conviction long-term ideas.

Roku, Inc. (NASDAQ:ROKU) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 33 hedge funds’ portfolios at the end of the second quarter of 2019. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Jack Henry & Associates, Inc. (NASDAQ:JKHY), PTC Inc (NASDAQ:PTC), and The Trade Desk, Inc. (NASDAQ:TTD) to gather more data points. Our calculations also showed that ROKU isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the fresh hedge fund action surrounding Roku, Inc. (NASDAQ:ROKU).

How are hedge funds trading Roku, Inc. (NASDAQ:ROKU)?

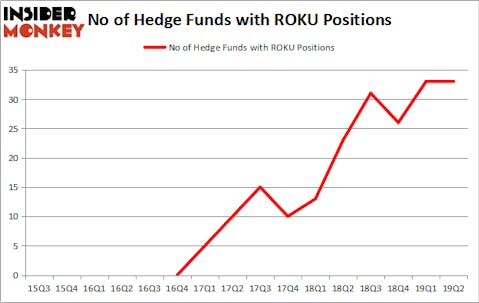

Heading into the third quarter of 2019, a total of 33 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in ROKU over the last 16 quarters. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Citadel Investment Group, managed by Ken Griffin, holds the most valuable position in Roku, Inc. (NASDAQ:ROKU). Citadel Investment Group has a $207.9 million call position in the stock, comprising 0.1% of its 13F portfolio. Sitting at the No. 2 spot is Renaissance Technologies, with a $191.6 million position; 0.2% of its 13F portfolio is allocated to the company. Some other professional money managers that are bullish consist of Alex Sacerdote’s Whale Rock Capital Management, and Israel Englander’s Millennium Management.

Judging by the fact that Roku, Inc. (NASDAQ:ROKU) has faced falling interest from the aggregate hedge fund industry, logic holds that there were a few hedge funds that decided to sell off their positions entirely last quarter. Interestingly, Cristan Blackman’s Empirical Capital Partners said goodbye to the largest investment of all the hedgies followed by Insider Monkey, comprising an estimated $13 million in stock, and Robert Bishop’s Impala Asset Management was right behind this move, as the fund dumped about $12.9 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Roku, Inc. (NASDAQ:ROKU) but similarly valued. We will take a look at Jack Henry & Associates, Inc. (NASDAQ:JKHY), PTC Inc (NASDAQ:PTC), The Trade Desk, Inc. (NASDAQ:TTD), and Noble Energy, Inc. (NYSE:NBL). This group of stocks’ market values are closest to ROKU’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JKHY | 18 | 132769 | 1 |

| PTC | 23 | 1197320 | -2 |

| TTD | 24 | 348201 | -1 |

| NBL | 25 | 808173 | 1 |

| Average | 22.5 | 621616 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $622 million. That figure was $550 million in ROKU’s case. Noble Energy, Inc. (NYSE:NBL) is the most popular stock in this table. On the other hand Jack Henry & Associates, Inc. (NASDAQ:JKHY) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Roku, Inc. (NASDAQ:ROKU) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on ROKU as the stock returned 12.3% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.