Hedge funds are known to underperform the bull markets but that’s not because they are bad at investing. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. Hedge funds underperform because they are hedged. The Standard and Poor’s 500 Index ETFs returned approximately 27.5% through the end of November (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 37.4% during the same period. An average long/short hedge fund returned only a fraction of this due to the hedges they implement and the large fees they charge. Our research covering the last 18 years indicates that investors can outperform the market by imitating hedge funds’ consensus stock picks rather than directly investing in hedge funds. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Pretium Resources Inc (NYSE:PVG).

Pretium Resources Inc (NYSE:PVG) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 22 hedge funds’ portfolios at the end of September. At the end of this article we will also compare PVG to other stocks including First Merchants Corporation (NASDAQ:FRME), Myriad Genetics, Inc. (NASDAQ:MYGN), and Flagstar Bancorp Inc (NYSE:FBC) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Roberto Mignone of Bridger Management

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the latest hedge fund action regarding Pretium Resources Inc (NYSE:PVG).

How have hedgies been trading Pretium Resources Inc (NYSE:PVG)?

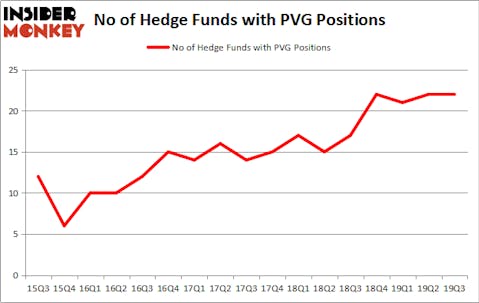

Heading into the fourth quarter of 2019, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in PVG over the last 17 quarters. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

More specifically, Polar Capital was the largest shareholder of Pretium Resources Inc (NYSE:PVG), with a stake worth $23.3 million reported as of the end of September. Trailing Polar Capital was PEAK6 Capital Management, which amassed a stake valued at $20.5 million. Bridger Management, Arrowstreet Capital, and Renaissance Technologies were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Sprott Asset Management allocated the biggest weight to Pretium Resources Inc (NYSE:PVG), around 2.74% of its 13F portfolio. Anchor Bolt Capital is also relatively very bullish on the stock, designating 1.64 percent of its 13F equity portfolio to PVG.

Because Pretium Resources Inc (NYSE:PVG) has witnessed a decline in interest from the entirety of the hedge funds we track, it’s easy to see that there lies a certain “tier” of fund managers that elected to cut their entire stakes last quarter. Interestingly, Howard Marks’s Oaktree Capital Management cut the largest stake of all the hedgies followed by Insider Monkey, comprising about $1.4 million in stock, and Noam Gottesman’s GLG Partners was right behind this move, as the fund cut about $0.9 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Pretium Resources Inc (NYSE:PVG) but similarly valued. These stocks are First Merchants Corporation (NASDAQ:FRME), Myriad Genetics, Inc. (NASDAQ:MYGN), Flagstar Bancorp Inc (NYSE:FBC), and Deluxe Corporation (NYSE:DLX). All of these stocks’ market caps are similar to PVG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FRME | 10 | 91788 | 0 |

| MYGN | 13 | 240082 | -2 |

| FBC | 15 | 71841 | 0 |

| DLX | 23 | 134255 | 4 |

| Average | 15.25 | 134492 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $134 million. That figure was $121 million in PVG’s case. Deluxe Corporation (NYSE:DLX) is the most popular stock in this table. On the other hand First Merchants Corporation (NASDAQ:FRME) is the least popular one with only 10 bullish hedge fund positions. Pretium Resources Inc (NYSE:PVG) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately PVG wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PVG were disappointed as the stock returned -15.3% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.