In this article you are going to find out whether hedge funds think OneSpaWorld Holdings Limited (NASDAQ:OSW) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

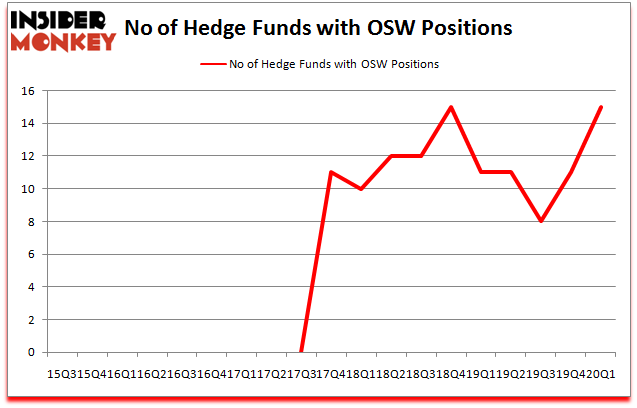

Is OneSpaWorld Holdings Limited (NASDAQ:OSW) the right investment to pursue these days? The best stock pickers are becoming more confident. The number of bullish hedge fund bets rose by 4 in recent months. Our calculations also showed that OSW isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). OSW was in 15 hedge funds’ portfolios at the end of March. There were 11 hedge funds in our database with OSW positions at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are dozens of tools market participants can use to grade publicly traded companies. Two of the best tools are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the best fund managers can outperform the S&P 500 by a very impressive margin (see the details here).

John Rogers of Ariel Investments

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, blockchain technology’s influence will go beyond online payments. So, we are checking out this futurist’s moonshot opportunities in tech stocks. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind let’s take a look at the latest hedge fund action regarding OneSpaWorld Holdings Limited (NASDAQ:OSW).

Hedge fund activity in OneSpaWorld Holdings Limited (NASDAQ:OSW)

At the end of the first quarter, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 36% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards OSW over the last 18 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ariel Investments, managed by John W. Rogers, holds the biggest position in OneSpaWorld Holdings Limited (NASDAQ:OSW). Ariel Investments has a $7 million position in the stock, comprising 0.1% of its 13F portfolio. On Ariel Investments’s heels is Jordan Moelis and Jeff Farroni of Deep Field Asset Management, with a $6.7 million position; 4.1% of its 13F portfolio is allocated to the company. Some other peers with similar optimism encompass Angela Aldrich’s Bayberry Capital Partners, Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management and Joe Milano’s Greenhouse Funds. In terms of the portfolio weights assigned to each position Deep Field Asset Management allocated the biggest weight to OneSpaWorld Holdings Limited (NASDAQ:OSW), around 4.09% of its 13F portfolio. Bayberry Capital Partners is also relatively very bullish on the stock, setting aside 2.08 percent of its 13F equity portfolio to OSW.

As one would reasonably expect, key money managers have jumped into OneSpaWorld Holdings Limited (NASDAQ:OSW) headfirst. Ariel Investments, managed by John W. Rogers, established the largest position in OneSpaWorld Holdings Limited (NASDAQ:OSW). Ariel Investments had $7 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $2.3 million position during the quarter. The following funds were also among the new OSW investors: John Overdeck and David Siegel’s Two Sigma Advisors, Ken Griffin’s Citadel Investment Group, and D. E. Shaw’s D E Shaw.

Let’s now take a look at hedge fund activity in other stocks similar to OneSpaWorld Holdings Limited (NASDAQ:OSW). We will take a look at Civista Bancshares, Inc. (NASDAQ:CIVB), Consolidated Water Co. Ltd. (NASDAQ:CWCO), Cross Country Healthcare, Inc. (NASDAQ:CCRN), and Magenta Therapeutics, Inc. (NASDAQ:MGTA). This group of stocks’ market caps match OSW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CIVB | 11 | 13075 | 1 |

| CWCO | 5 | 14678 | 0 |

| CCRN | 13 | 19751 | 1 |

| MGTA | 10 | 32359 | 1 |

| Average | 9.75 | 19966 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $20 million. That figure was $33 million in OSW’s case. Cross Country Healthcare, Inc. (NASDAQ:CCRN) is the most popular stock in this table. On the other hand Consolidated Water Co. Ltd. (NASDAQ:CWCO) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks OneSpaWorld Holdings Limited (NASDAQ:OSW) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.3% in 2020 through June 25th and still beat the market by 16.8 percentage points. Unfortunately OSW wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on OSW were disappointed as the stock returned 24.6% during the second quarter (through June 25th) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Onespaworld Holdings Ltd (NASDAQ:OSW)

Follow Onespaworld Holdings Ltd (NASDAQ:OSW)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.