Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards OneSpan Inc. (NASDAQ:OSPN).

Hedge fund interest in OneSpan Inc. (NASDAQ:OSPN) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Independence Holding Company (NYSE:IHC), Niu Technologies (NASDAQ:NIU), and Gladstone Commercial Corporation (NASDAQ:GOOD) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to review the latest hedge fund action surrounding OneSpan Inc. (NASDAQ:OSPN).

What have hedge funds been doing with OneSpan Inc. (NASDAQ:OSPN)?

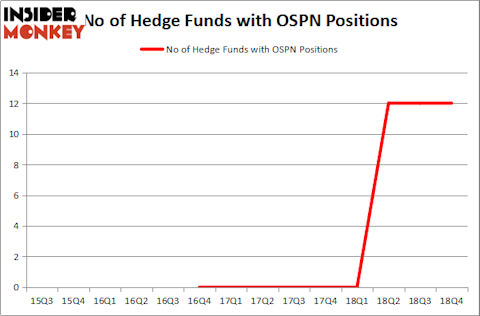

At the end of the fourth quarter, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards OSPN over the last 14 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

The largest stake in OneSpan Inc. (NASDAQ:OSPN) was held by Legion Partners Asset Management, which reported holding $27.1 million worth of stock at the end of December. It was followed by Ancora Advisors with a $9 million position. Other investors bullish on the company included Archon Capital Management, D E Shaw, and Renaissance Technologies.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: GLG Partners. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Royce & Associates).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as OneSpan Inc. (NASDAQ:OSPN) but similarly valued. We will take a look at Independence Holding Company (NYSE:IHC), Niu Technologies (NASDAQ:NIU), Gladstone Commercial Corporation (NASDAQ:GOOD), and Superior Energy Services, Inc. (NYSE:SPN). All of these stocks’ market caps resemble OSPN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IHC | 3 | 14499 | -1 |

| NIU | 3 | 21884 | 3 |

| GOOD | 7 | 52227 | 1 |

| SPN | 20 | 79727 | 3 |

| Average | 8.25 | 42084 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.25 hedge funds with bullish positions and the average amount invested in these stocks was $42 million. That figure was $58 million in OSPN’s case. Superior Energy Services, Inc. (NYSE:SPN) is the most popular stock in this table. On the other hand Independence Holding Company (NYSE:IHC) is the least popular one with only 3 bullish hedge fund positions. OneSpan Inc. (NASDAQ:OSPN) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on OSPN as the stock returned 32.7% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.