How do we determine whether NIC Inc. (NASDAQ:EGOV) makes for a good investment at the moment? We analyze the sentiment of a select group of the very best investors in the world, who spend immense amounts of time and resources studying companies. They may not always be right (no one is), but data shows that their consensus long positions have historically outperformed the market when we adjust for known risk factors.

NIC Inc. (NASDAQ:EGOV) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged but stood at its all time high that was reached at the end of September. The stock was in 18 hedge funds’ portfolios at the end of December. This is usually a very bullish indicator. For example hedge fund positions in Xerox jumped to its all time high by the end of December and the stock returned more than 72% in the following 3 months or so. Another example is Trade Desk Inc. Hedge fund sentiment towards the stock was also at its all time high at the beginning of this year and the stock returned more than 81% in 3.5 months. Similarly Xilinx, Alteryx and EEFT returned more than 40% after hedge fund sentiment hit its all time high at the end of December. We observed similar performances from OKTA, Twilio, CCK, MSCI, MASI and Progressive Corporation (PGR); these stocks returned 37%, 37%, 35%, 29%, 28% and 27% respectively. There were actually more than 500 stocks that hit all time highs in terms of hedge fund sentiment at the end of December. These stocks delivered an average gain of 22.2% in 2019 through April 25th and outperformed the S&P 500 Index by about 5 percentage points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Matthew Hulsizer of PEAK6 Capital

Let’s go over the key hedge fund action regarding NIC Inc. (NASDAQ:EGOV).

What have hedge funds been doing with NIC Inc. (NASDAQ:EGOV)?

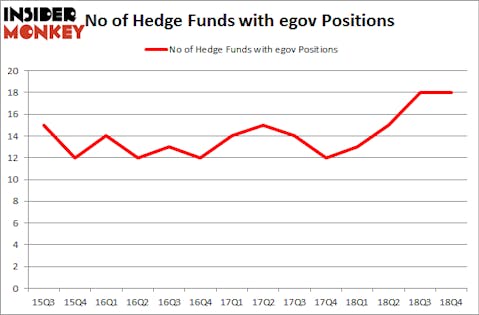

At Q4’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in EGOV over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, D E Shaw was the largest shareholder of NIC Inc. (NASDAQ:EGOV), with a stake worth $15.2 million reported as of the end of September. Trailing D E Shaw was Marshall Wace LLP, which amassed a stake valued at $11.4 million. GLG Partners, Stadium Capital Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Because NIC Inc. (NASDAQ:EGOV) has faced a decline in interest from the smart money, logic holds that there is a sect of money managers that elected to cut their entire stakes by the end of the third quarter. At the top of the heap, Michael Platt and William Reeves’s BlueCrest Capital Mgmt. dumped the largest investment of the 700 funds followed by Insider Monkey, worth close to $1.1 million in stock. Matthew Hulsizer’s fund, PEAK6 Capital Management, also dropped its stock, about $0.6 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as NIC Inc. (NASDAQ:EGOV) but similarly valued. We will take a look at InVitae Corporation (NYSE:NVTA), California Resources Corporation (NYSE:CRC), Fate Therapeutics Inc (NASDAQ:FATE), and Churchill Capital Corp (NYSE:CCC). This group of stocks’ market valuations match EGOV’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NVTA | 24 | 167691 | 4 |

| CRC | 20 | 138010 | -2 |

| FATE | 15 | 285651 | -2 |

| CCC | 24 | 316832 | -1 |

| Average | 20.75 | 227046 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $227 million. That figure was $68 million in EGOV’s case. InVitae Corporation (NYSE:NVTA) is the most popular stock in this table. On the other hand Fate Therapeutics Inc (NASDAQ:FATE) is the least popular one with only 15 bullish hedge fund positions. NIC Inc. (NASDAQ:EGOV) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on EGOV as the stock returned 36.3% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.