Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before the Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first quarter, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first quarter still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Materion Corp (NYSE:MTRN) changed recently.

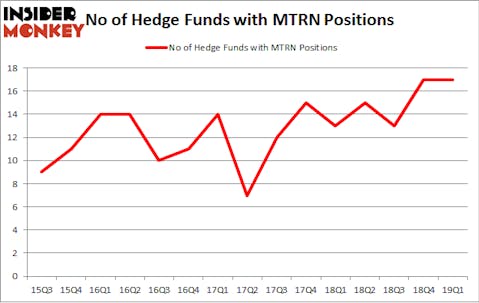

Materion Corp (NYSE:MTRN) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 17 hedge funds’ portfolios at the end of the first quarter of 2019. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as 1st Source Corporation (NASDAQ:SRCE), Lakeland Financial Corporation (NASDAQ:LKFN), and National HealthCare Corporation (NYSE:NHC) to gather more data points.

In the eyes of most market participants, hedge funds are perceived as worthless, old investment tools of years past. While there are more than 8000 funds with their doors open at the moment, Our experts hone in on the bigwigs of this group, about 750 funds. It is estimated that this group of investors manage the lion’s share of the smart money’s total asset base, and by shadowing their highest performing investments, Insider Monkey has unearthed various investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Noam Gottesman, GLG Partners

We’re going to go over the fresh hedge fund action encompassing Materion Corp (NYSE:MTRN).

What does smart money think about Materion Corp (NYSE:MTRN)?

At Q1’s end, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2018. By comparison, 13 hedge funds held shares or bullish call options in MTRN a year ago. With the smart money’s sentiment swirling, there exists a select group of notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

More specifically, GAMCO Investors was the largest shareholder of Materion Corp (NYSE:MTRN), with a stake worth $32.4 million reported as of the end of March. Trailing GAMCO Investors was GLG Partners, which amassed a stake valued at $10.6 million. Renaissance Technologies, Millennium Management, and Arrowstreet Capital were also very fond of the stock, giving the stock large weights in their portfolios.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Stevens Capital Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Royce & Associates).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Materion Corp (NYSE:MTRN) but similarly valued. These stocks are 1st Source Corporation (NASDAQ:SRCE), Lakeland Financial Corporation (NASDAQ:LKFN), National HealthCare Corporation (NYSE:NHC), and Hess Midstream Partners LP (NYSE:HESM). This group of stocks’ market caps resemble MTRN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SRCE | 9 | 26986 | 0 |

| LKFN | 11 | 18601 | 0 |

| NHC | 9 | 52872 | 0 |

| HESM | 6 | 4199 | 0 |

| Average | 8.75 | 25665 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.75 hedge funds with bullish positions and the average amount invested in these stocks was $26 million. That figure was $91 million in MTRN’s case. Lakeland Financial Corporation (NASDAQ:LKFN) is the most popular stock in this table. On the other hand Hess Midstream Partners LP (NYSE:HESM) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Materion Corp (NYSE:MTRN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on MTRN as the stock returned 16.4% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.