Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 2.5 months of this year the Standard and Poor’s 500 Index returned approximately 13.1% (including dividend payments). Conversely, hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the same 2.5-month period, with 93% of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only 5% due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns (5%) versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like Lakeland Bancorp, Inc. (NASDAQ:LBAI).

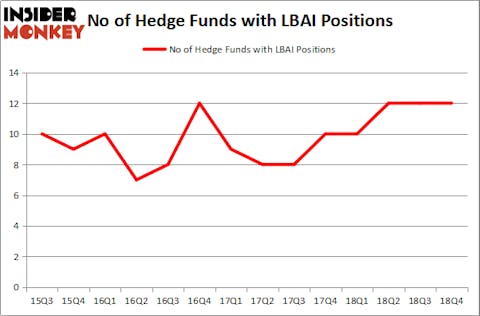

Lakeland Bancorp, Inc. (NASDAQ:LBAI) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 12 hedge funds’ portfolios at the end of the fourth quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Lexicon Pharmaceuticals, Inc. (NASDAQ:LXRX), Central European Media Enterprises Ltd. (NASDAQ:CETV), and Stoneridge, Inc. (NYSE:SRI) to gather more data points.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to check out the key hedge fund action regarding Lakeland Bancorp, Inc. (NASDAQ:LBAI).

How have hedgies been trading Lakeland Bancorp, Inc. (NASDAQ:LBAI)?

At Q4’s end, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. By comparison, 10 hedge funds held shares or bullish call options in LBAI a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

Among these funds, Cardinal Capital held the most valuable stake in Lakeland Bancorp, Inc. (NASDAQ:LBAI), which was worth $33.4 million at the end of the fourth quarter. On the second spot was Renaissance Technologies which amassed $11.1 million worth of shares. Moreover, Mendon Capital Advisors, Marshall Wace LLP, and Basswood Capital were also bullish on Lakeland Bancorp, Inc. (NASDAQ:LBAI), allocating a large percentage of their portfolios to this stock.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Citadel Investment Group. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Algert Coldiron Investors).

Let’s now review hedge fund activity in other stocks similar to Lakeland Bancorp, Inc. (NASDAQ:LBAI). These stocks are Lexicon Pharmaceuticals, Inc. (NASDAQ:LXRX), Central European Media Enterprises Ltd. (NASDAQ:CETV), Stoneridge, Inc. (NYSE:SRI), and Community Trust Bancorp, Inc. (NASDAQ:CTBI). This group of stocks’ market caps are closest to LBAI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LXRX | 11 | 10453 | 1 |

| CETV | 5 | 1243 | -2 |

| SRI | 15 | 71331 | -3 |

| CTBI | 7 | 16240 | -2 |

| Average | 9.5 | 24817 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $25 million. That figure was $59 million in LBAI’s case. Stoneridge, Inc. (NYSE:SRI) is the most popular stock in this table. On the other hand Central European Media Enterprises Ltd. (NASDAQ:CETV) is the least popular one with only 5 bullish hedge fund positions. Lakeland Bancorp, Inc. (NASDAQ:LBAI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately LBAI wasn’t nearly as popular as these 15 stock and hedge funds that were betting on LBAI were disappointed as the stock returned 4.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.