Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of IDT Corporation (NYSE:IDT).

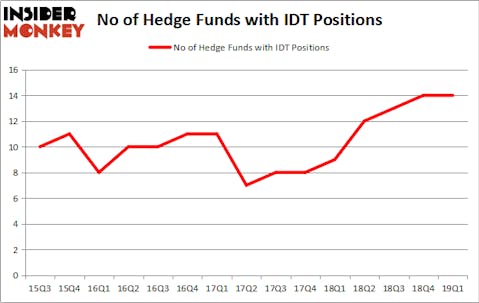

IDT Corporation (NYSE:IDT) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 14 hedge funds’ portfolios at the end of March. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Olympic Steel, Inc. (NASDAQ:ZEUS), Akoustis Technologies, Inc. (NASDAQ:AKTS), and Paratek Pharmaceuticals Inc (NASDAQ:PRTK) to gather more data points.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the key hedge fund action encompassing IDT Corporation (NYSE:IDT).

What does smart money think about IDT Corporation (NYSE:IDT)?

Heading into the second quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards IDT over the last 15 quarters. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in IDT Corporation (NYSE:IDT), which was worth $11 million at the end of the first quarter. On the second spot was D E Shaw which amassed $6 million worth of shares. Moreover, Millennium Management, Arrowstreet Capital, and Royce & Associates were also bullish on IDT Corporation (NYSE:IDT), allocating a large percentage of their portfolios to this stock.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Kahn Brothers. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Arrowstreet Capital).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as IDT Corporation (NYSE:IDT) but similarly valued. These stocks are Olympic Steel, Inc. (NASDAQ:ZEUS), Akoustis Technologies, Inc. (NASDAQ:AKTS), Paratek Pharmaceuticals Inc (NASDAQ:PRTK), and The GDL Fund (NYSE:GDL). This group of stocks’ market valuations match IDT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZEUS | 8 | 4368 | 2 |

| AKTS | 8 | 5028 | 4 |

| PRTK | 14 | 56810 | 0 |

| GDL | 3 | 5825 | 0 |

| Average | 8.25 | 18008 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.25 hedge funds with bullish positions and the average amount invested in these stocks was $18 million. That figure was $22 million in IDT’s case. Paratek Pharmaceuticals Inc (NASDAQ:PRTK) is the most popular stock in this table. On the other hand The GDL Fund (NYSE:GDL) is the least popular one with only 3 bullish hedge fund positions. IDT Corporation (NYSE:IDT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on IDT as the stock returned 32.7% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.