At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of September 30. In this article, we will use that wealth of knowledge to determine whether or not Hyster-Yale Materials Handling Inc (NYSE:HY) makes for a good investment right now.

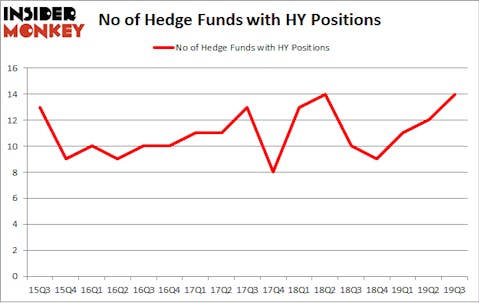

Hyster-Yale Materials Handling Inc (NYSE:HY) investors should be aware of an increase in enthusiasm from smart money recently. HY was in 14 hedge funds’ portfolios at the end of the third quarter of 2019. There were 12 hedge funds in our database with HY holdings at the end of the previous quarter. Our calculations also showed that HY isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Ric Dillon of Diamond Hill Capital

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a look at the key hedge fund action encompassing Hyster-Yale Materials Handling Inc (NYSE:HY).

What does smart money think about Hyster-Yale Materials Handling Inc (NYSE:HY)?

At Q3’s end, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from the previous quarter. The graph below displays the number of hedge funds with bullish position in HY over the last 17 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

More specifically, Royce & Associates was the largest shareholder of Hyster-Yale Materials Handling Inc (NYSE:HY), with a stake worth $13 million reported as of the end of September. Trailing Royce & Associates was Diamond Hill Capital, which amassed a stake valued at $8.1 million. Fisher Asset Management, Citadel Investment Group, and Two Sigma Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Royce & Associates allocated the biggest weight to Hyster-Yale Materials Handling Inc (NYSE:HY), around 0.12% of its 13F portfolio. Weld Capital Management is also relatively very bullish on the stock, earmarking 0.08 percent of its 13F equity portfolio to HY.

As aggregate interest increased, specific money managers have been driving this bullishness. D E Shaw, managed by David E. Shaw, established the most outsized call position in Hyster-Yale Materials Handling Inc (NYSE:HY). D E Shaw had $1.1 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also initiated a $1 million position during the quarter. The other funds with new positions in the stock are Mario Gabelli’s GAMCO Investors and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now review hedge fund activity in other stocks similar to Hyster-Yale Materials Handling Inc (NYSE:HY). These stocks are Republic Bancorp, Inc. (NASDAQ:RBCAA), The Gorman-Rupp Company (NYSE:GRC), Zealand Pharma A/S (NASDAQ:ZEAL), and General American Investors Company, Inc. (NYSE:GAM). All of these stocks’ market caps are closest to HY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RBCAA | 7 | 15262 | 1 |

| GRC | 9 | 43037 | 2 |

| ZEAL | 3 | 26137 | 1 |

| GAM | 5 | 27837 | 0 |

| Average | 6 | 28068 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $28 million. That figure was $33 million in HY’s case. The Gorman-Rupp Company (NYSE:GRC) is the most popular stock in this table. On the other hand Zealand Pharma A/S (NASDAQ:ZEAL) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Hyster-Yale Materials Handling Inc (NYSE:HY) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on HY, though not to the same extent, as the stock returned 8.8% during the fourth quarter (through the end of November) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.