A market correction in the fourth quarter, spurred by a number of global macroeconomic concerns and rising interest rates ended up having a negative impact on the markets and many hedge funds as a result. The stocks of smaller companies were especially hard hit during this time as investors fled to investments seen as being safer. This is evident in the fact that the Russell 2000 ETF underperformed the S&P 500 ETF by nearly 7 percentage points during the fourth quarter. We also received indications that hedge funds were trimming their positions amid the market volatility and uncertainty, and given their greater inclination towards smaller cap stocks than other investors, it follows that a stronger sell-off occurred in those stocks. Let’s study the hedge fund sentiment to see how those concerns affected their ownership of First American Financial Corp (NYSE:FAF) during the quarter.

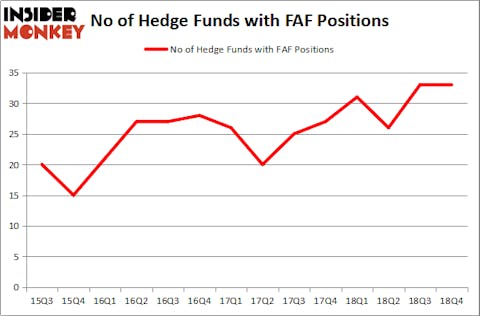

First American Financial Corp (NYSE:FAF) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 33 hedge funds’ portfolios at the end of the fourth quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Planet Fitness Inc (NYSE:PLNT), ServiceMaster Global Holdings Inc (NYSE:SERV), and Carvana Co. (NYSE:CVNA) to gather more data points.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to view the new hedge fund action regarding First American Financial Corp (NYSE:FAF).

Hedge fund activity in First American Financial Corp (NYSE:FAF)

At the end of the fourth quarter, a total of 33 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 31 hedge funds with a bullish position in FAF a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Ariel Investments was the largest shareholder of First American Financial Corp (NYSE:FAF), with a stake worth $197.4 million reported as of the end of September. Trailing Ariel Investments was AQR Capital Management, which amassed a stake valued at $74 million. Fisher Asset Management, Millennium Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that First American Financial Corp (NYSE:FAF) has experienced falling interest from the smart money, we can see that there lies a certain “tier” of hedgies that elected to cut their entire stakes by the end of the third quarter. It’s worth mentioning that Peter Seuss’s Prana Capital Management said goodbye to the largest stake of all the hedgies watched by Insider Monkey, valued at an estimated $9.5 million in stock, and Mariko Gordon’s Daruma Asset Management was right behind this move, as the fund said goodbye to about $3.8 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to First American Financial Corp (NYSE:FAF). These stocks are Planet Fitness Inc (NYSE:PLNT), ServiceMaster Global Holdings Inc (NYSE:SERV), Carvana Co. (NYSE:CVNA), and Flowserve Corporation (NYSE:FLS). This group of stocks’ market valuations resemble FAF’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PLNT | 30 | 375685 | -2 |

| SERV | 27 | 465302 | -9 |

| CVNA | 34 | 790686 | 1 |

| FLS | 16 | 178905 | 3 |

| Average | 26.75 | 452645 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.75 hedge funds with bullish positions and the average amount invested in these stocks was $453 million. That figure was $574 million in FAF’s case. Carvana Co. (NYSE:CVNA) is the most popular stock in this table. On the other hand Flowserve Corporation (NYSE:FLS) is the least popular one with only 16 bullish hedge fund positions. First American Financial Corp (NYSE:FAF) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on FAF as the stock returned 25.2% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.