Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Things completely reversed during the first quarter. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards EXACT Sciences Corporation (NASDAQ:EXAS) to find out whether it was one of their high conviction long-term ideas.

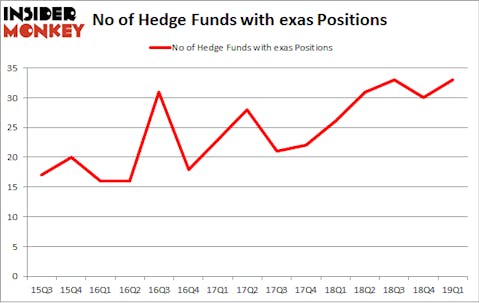

EXACT Sciences Corporation (NASDAQ:EXAS) has experienced an increase in hedge fund sentiment in recent months. Our calculations also showed that exas isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to check out the new hedge fund action regarding EXACT Sciences Corporation (NASDAQ:EXAS).

What does the smart money think about EXACT Sciences Corporation (NASDAQ:EXAS)?

At the end of the first quarter, a total of 33 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 10% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards EXAS over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in EXACT Sciences Corporation (NASDAQ:EXAS) was held by Viking Global, which reported holding $278.5 million worth of stock at the end of March. It was followed by D E Shaw with a $216.3 million position. Other investors bullish on the company included Partner Fund Management, Millennium Management, and Rock Springs Capital Management.

As industrywide interest jumped, some big names were leading the bulls’ herd. Partner Fund Management, managed by Christopher James, created the most outsized position in EXACT Sciences Corporation (NASDAQ:EXAS). Partner Fund Management had $49.1 million invested in the company at the end of the quarter. James Crichton’s Hitchwood Capital Management also initiated a $19.5 million position during the quarter. The other funds with brand new EXAS positions are John Overdeck and David Siegel’s Two Sigma Advisors, Michael Platt and William Reeves’s BlueCrest Capital Mgmt., and Jim Simons’s Renaissance Technologies.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as EXACT Sciences Corporation (NASDAQ:EXAS) but similarly valued. These stocks are EnCana Corporation (NYSE:ECA), Steris Plc (NYSE:STE), Pinnacle West Capital Corporation (NYSE:PNW), and DexCom, Inc. (NASDAQ:DXCM). This group of stocks’ market valuations match EXAS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ECA | 44 | 1002031 | 4 |

| STE | 21 | 319546 | -1 |

| PNW | 24 | 720582 | -2 |

| DXCM | 33 | 804444 | 2 |

| Average | 30.5 | 711651 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.5 hedge funds with bullish positions and the average amount invested in these stocks was $712 million. That figure was $815 million in EXAS’s case. EnCana Corporation (NYSE:ECA) is the most popular stock in this table. On the other hand Steris Plc (NYSE:STE) is the least popular one with only 21 bullish hedge fund positions. EXACT Sciences Corporation (NASDAQ:EXAS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on EXAS as the stock returned 17.2% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.