We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the fourth quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4 years and analyze what the smart money thinks of eHealth, Inc. (NASDAQ:EHTH) based on that data.

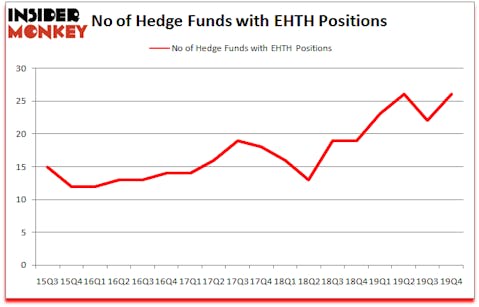

eHealth, Inc. (NASDAQ:EHTH) has experienced an increase in activity from the world’s largest hedge funds recently. EHTH was in 26 hedge funds’ portfolios at the end of December. There were 22 hedge funds in our database with EHTH holdings at the end of the previous quarter. Our calculations also showed that EHTH isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

Today there are tons of metrics stock traders employ to appraise their holdings. A duo of the most under-the-radar metrics are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the elite fund managers can beat the market by a very impressive amount (see the details here).

Samuel Isaly of OrbiMed Advisors

We leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we are checking out investment opportunities like this one. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s check out the new hedge fund action encompassing eHealth, Inc. (NASDAQ:EHTH).

What have hedge funds been doing with eHealth, Inc. (NASDAQ:EHTH)?

Heading into the first quarter of 2020, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 18% from the previous quarter. On the other hand, there were a total of 19 hedge funds with a bullish position in EHTH a year ago. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Samuel Isaly’s OrbiMed Advisors has the largest position in eHealth, Inc. (NASDAQ:EHTH), worth close to $106.8 million, comprising 1.5% of its total 13F portfolio. Sitting at the No. 2 spot is Travis Cocke of Voss Capital, with a $97.1 million call position; 14.6% of its 13F portfolio is allocated to the company. Remaining peers with similar optimism comprise Daniel Patrick Gibson’s Sylebra Capital Management, Ken Griffin’s Citadel Investment Group and Stephen Perkins’s Toronado Partners. In terms of the portfolio weights assigned to each position Voss Capital allocated the biggest weight to eHealth, Inc. (NASDAQ:EHTH), around 14.63% of its 13F portfolio. Toronado Partners is also relatively very bullish on the stock, designating 10.3 percent of its 13F equity portfolio to EHTH.

As industrywide interest jumped, specific money managers were breaking ground themselves. Balyasny Asset Management, managed by Dmitry Balyasny, established the most outsized position in eHealth, Inc. (NASDAQ:EHTH). Balyasny Asset Management had $13.3 million invested in the company at the end of the quarter. George McCabe’s Portolan Capital Management also made a $11.1 million investment in the stock during the quarter. The following funds were also among the new EHTH investors: Travis Cocke’s Voss Capital, Harry Gail’s Harspring Capital Management, and Michael Kharitonov and Jon David McAuliffe’s Voleon Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as eHealth, Inc. (NASDAQ:EHTH) but similarly valued. We will take a look at DiamondRock Hospitality Company (NYSE:DRH), Genworth Financial Inc (NYSE:GNW), Crestwood Equity Partners LP (NYSE:CEQP), and Ra Pharmaceuticals, Inc. (NASDAQ:RARX). This group of stocks’ market caps resemble EHTH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DRH | 17 | 72890 | -1 |

| GNW | 32 | 278398 | 3 |

| CEQP | 6 | 16286 | -1 |

| RARX | 28 | 863481 | 7 |

| Average | 20.75 | 307764 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $308 million. That figure was $459 million in EHTH’s case. Genworth Financial Inc (NYSE:GNW) is the most popular stock in this table. On the other hand Crestwood Equity Partners LP (NYSE:CEQP) is the least popular one with only 6 bullish hedge fund positions. eHealth, Inc. (NASDAQ:EHTH) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 13.0% in 2020 through April 6th but still beat the market by 4.2 percentage points. Hedge funds were also right about betting on EHTH as the stock returned 35.9% in 2020 (through April 6th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.