Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 2.5 months of this year the Standard and Poor’s 500 Index returned approximately 13.1% (including dividend payments). Conversely, hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the same 2.5-month period, with 93% of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only 5% due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns (5%) versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like Eagle Pharmaceuticals Inc (NASDAQ:EGRX).

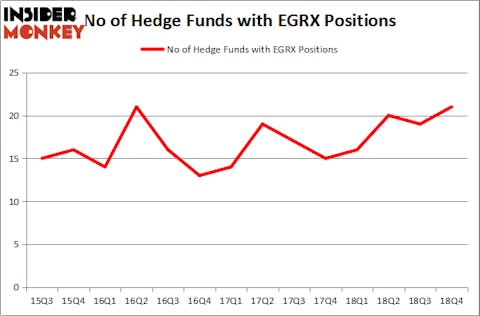

Is Eagle Pharmaceuticals Inc (NASDAQ:EGRX) going to take off soon? Money managers are buying. The number of bullish hedge fund bets rose by 2 recently. Our calculations also showed that EGRX isn’t among the 30 most popular stocks among hedge funds. EGRX was in 21 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 19 hedge funds in our database with EGRX positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to check out the recent hedge fund action encompassing Eagle Pharmaceuticals Inc (NASDAQ:EGRX).

How have hedgies been trading Eagle Pharmaceuticals Inc (NASDAQ:EGRX)?

At the end of the fourth quarter, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 11% from the previous quarter. By comparison, 16 hedge funds held shares or bullish call options in EGRX a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Peter S. Park’s Park West Asset Management has the number one position in Eagle Pharmaceuticals Inc (NASDAQ:EGRX), worth close to $42.3 million, accounting for 2.1% of its total 13F portfolio. Sitting at the No. 2 spot is Hudson Executive Capital, managed by Douglas Braunstein and James Woolery, which holds a $39.1 million position; the fund has 4% of its 13F portfolio invested in the stock. Some other peers that hold long positions comprise Stephen DuBois’s Camber Capital Management, D. E. Shaw’s D E Shaw and Israel Englander’s Millennium Management.

Now, key hedge funds have been driving this bullishness. Winton Capital Management, managed by David Harding, created the biggest position in Eagle Pharmaceuticals Inc (NASDAQ:EGRX). Winton Capital Management had $9.6 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $4.5 million position during the quarter. The other funds with new positions in the stock are Dmitry Balyasny’s Balyasny Asset Management, Bradley Louis Radoff’s Fondren Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s go over hedge fund activity in other stocks similar to Eagle Pharmaceuticals Inc (NASDAQ:EGRX). We will take a look at Adaptimmune Therapeutics plc (NASDAQ:ADAP), Pzena Investment Management Inc (NYSE:PZN), Conn’s, Inc. (NASDAQ:CONN), and Cresud S.A.C.I.F. y A. (NASDAQ:CRESY). This group of stocks’ market valuations resemble EGRX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ADAP | 12 | 196466 | -1 |

| PZN | 5 | 14906 | 1 |

| CONN | 14 | 151488 | -5 |

| CRESY | 7 | 26789 | 2 |

| Average | 9.5 | 97412 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $97 million. That figure was $144 million in EGRX’s case. Conn’s, Inc. (NASDAQ:CONN) is the most popular stock in this table. On the other hand Pzena Investment Management Inc (NYSE:PZN) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Eagle Pharmaceuticals Inc (NASDAQ:EGRX) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on EGRX, though not to the same extent, as the stock returned 20.5% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.