“The end to the U.S. Government shutdown, reports of progress on China-U.S. trade talks, and the Federal Reserve’s confirmation that it did not plan further interest rate hikes in 2019 allayed investor fears and drove U.S. markets substantially higher in the first quarter of the year. Global markets followed suit pretty much across the board delivering what some market participants described as a “V-shaped” recovery,” This is how Evermore Global Value summarized the first quarter in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

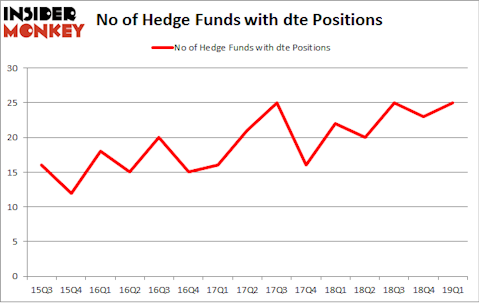

DTE Energy Company (NYSE:DTE) was in 25 hedge funds’ portfolios at the end of the first quarter of 2019. DTE investors should pay attention to an increase in enthusiasm from smart money of late. There were 23 hedge funds in our database with DTE positions at the end of the previous quarter. Our calculations also showed that dte isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the new hedge fund action surrounding DTE Energy Company (NYSE:DTE).

What does the smart money think about DTE Energy Company (NYSE:DTE)?

At Q1’s end, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 9% from the fourth quarter of 2018. On the other hand, there were a total of 22 hedge funds with a bullish position in DTE a year ago. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Simons’s Renaissance Technologies has the number one position in DTE Energy Company (NYSE:DTE), worth close to $261.4 million, corresponding to 0.2% of its total 13F portfolio. The second most bullish fund manager is AQR Capital Management, managed by Cliff Asness, which holds a $183.6 million position; 0.2% of its 13F portfolio is allocated to the company. Remaining peers that are bullish consist of Ken Griffin’s Citadel Investment Group, Noam Gottesman’s GLG Partners and Clint Carlson’s Carlson Capital.

As industrywide interest jumped, key money managers have jumped into DTE Energy Company (NYSE:DTE) headfirst. Carlson Capital, managed by Clint Carlson, initiated the biggest position in DTE Energy Company (NYSE:DTE). Carlson Capital had $41.9 million invested in the company at the end of the quarter. Phill Gross and Robert Atchinson’s Adage Capital Management also made a $28.2 million investment in the stock during the quarter. The following funds were also among the new DTE investors: Daniel S. Och’s OZ Management, Bernard Lambilliotte’s Ecofin Ltd, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as DTE Energy Company (NYSE:DTE) but similarly valued. These stocks are Palo Alto Networks Inc (NYSE:PANW), Ventas, Inc. (NYSE:VTR), Align Technology, Inc. (NASDAQ:ALGN), and Anadarko Petroleum Corporation (NYSE:APC). This group of stocks’ market values resemble DTE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PANW | 44 | 2558221 | -2 |

| VTR | 19 | 300131 | 5 |

| ALGN | 30 | 1756917 | -7 |

| APC | 50 | 2096400 | -4 |

| Average | 35.75 | 1677917 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.75 hedge funds with bullish positions and the average amount invested in these stocks was $1678 million. That figure was $719 million in DTE’s case. Anadarko Petroleum Corporation (NYSE:APC) is the most popular stock in this table. On the other hand Ventas, Inc. (NYSE:VTR) is the least popular one with only 19 bullish hedge fund positions. DTE Energy Company (NYSE:DTE) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on DTE, though not to the same extent, as the stock returned -0.4% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.