Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter. NASDAQ and Russell 2000 indices were already in correction territory. More importantly, Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points in the fourth quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Chesapeake Lodging Trust (NYSE:CHSP).

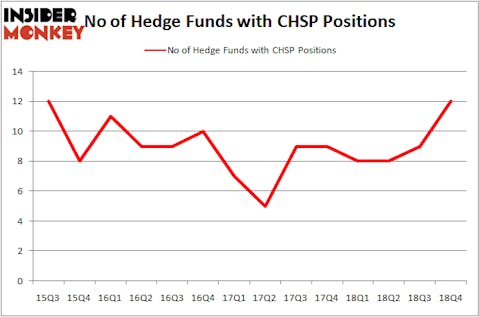

Is Chesapeake Lodging Trust (NYSE:CHSP) worth your attention right now? Prominent investors are taking an optimistic view. The number of bullish hedge fund bets inched up by 3 lately. Our calculations also showed that CHSP isn’t among the 30 most popular stocks among hedge funds. CHSP was in 12 hedge funds’ portfolios at the end of December. There were 9 hedge funds in our database with CHSP holdings at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a gander at the latest hedge fund action regarding Chesapeake Lodging Trust (NYSE:CHSP).

Hedge fund activity in Chesapeake Lodging Trust (NYSE:CHSP)

At Q4’s end, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of 33% from the second quarter of 2018. On the other hand, there were a total of 8 hedge funds with a bullish position in CHSP a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Chesapeake Lodging Trust (NYSE:CHSP) was held by Citadel Investment Group, which reported holding $5.1 million worth of stock at the end of December. It was followed by Renaissance Technologies with a $3.8 million position. Other investors bullish on the company included Balyasny Asset Management, Two Sigma Advisors, and D E Shaw.

As one would reasonably expect, key money managers have been driving this bullishness. Renaissance Technologies, managed by Jim Simons, created the biggest position in Chesapeake Lodging Trust (NYSE:CHSP). Renaissance Technologies had $3.8 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also made a $1 million investment in the stock during the quarter. The other funds with new positions in the stock are Israel Englander’s Millennium Management, Matthew Tewksbury’s Stevens Capital Management, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Chesapeake Lodging Trust (NYSE:CHSP) but similarly valued. These stocks are Cubic Corporation (NYSE:CUB), State Auto Financial Corporation (NASDAQ:STFC), Meritage Homes Corp (NYSE:MTH), and JELD-WEN Holding, Inc. (NYSE:JELD). This group of stocks’ market values are similar to CHSP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CUB | 22 | 97403 | 4 |

| STFC | 4 | 16052 | 1 |

| MTH | 13 | 156459 | 0 |

| JELD | 16 | 291975 | 3 |

| Average | 13.75 | 140472 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $140 million. That figure was $17 million in CHSP’s case. Cubic Corporation (NYSE:CUB) is the most popular stock in this table. On the other hand State Auto Financial Corporation (NASDAQ:STFC) is the least popular one with only 4 bullish hedge fund positions. Chesapeake Lodging Trust (NYSE:CHSP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CHSP wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); CHSP investors were disappointed as the stock returned 16.1% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.