Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before last year’s Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first half of 2019, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first half still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Bottomline Technologies (de), Inc. (NASDAQ:EPAY) changed recently.

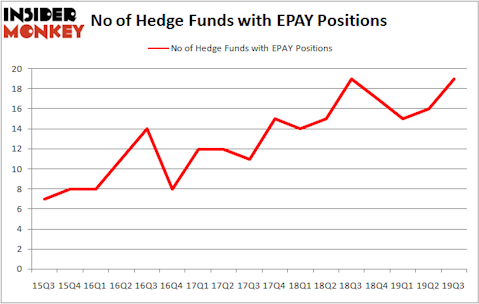

Is Bottomline Technologies (de), Inc. (NASDAQ:EPAY) a splendid investment right now? Prominent investors are becoming hopeful. The number of bullish hedge fund bets moved up by 3 in recent months. Our calculations also showed that EPAY isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most stock holders, hedge funds are viewed as slow, outdated investment tools of the past. While there are over 8000 funds trading today, Our experts hone in on the moguls of this group, approximately 750 funds. These hedge fund managers preside over the lion’s share of the hedge fund industry’s total asset base, and by following their top stock picks, Insider Monkey has brought to light many investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s check out the key hedge fund action encompassing Bottomline Technologies (de), Inc. (NASDAQ:EPAY).

What does smart money think about Bottomline Technologies (de), Inc. (NASDAQ:EPAY)?

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 19% from one quarter earlier. On the other hand, there were a total of 19 hedge funds with a bullish position in EPAY a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Bottomline Technologies (de), Inc. (NASDAQ:EPAY) was held by Fisher Asset Management, which reported holding $16.8 million worth of stock at the end of September. It was followed by Nishkama Capital with a $12.3 million position. Other investors bullish on the company included Millennium Management, Renaissance Technologies, and D E Shaw. In terms of the portfolio weights assigned to each position Nishkama Capital allocated the biggest weight to Bottomline Technologies (de), Inc. (NASDAQ:EPAY), around 13.22% of its 13F portfolio. Clearline Capital is also relatively very bullish on the stock, earmarking 1.38 percent of its 13F equity portfolio to EPAY.

As aggregate interest increased, some big names have been driving this bullishness. Clearline Capital, managed by Marc Majzner, established the most outsized position in Bottomline Technologies (de), Inc. (NASDAQ:EPAY). Clearline Capital had $3 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also initiated a $1.4 million position during the quarter. The other funds with brand new EPAY positions are Michael Gelband’s ExodusPoint Capital and Donald Sussman’s Paloma Partners.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Bottomline Technologies (de), Inc. (NASDAQ:EPAY) but similarly valued. These stocks are FGL Holdings (NYSE:FG), Patterson-UTI Energy, Inc. (NASDAQ:PTEN), Walker & Dunlop Inc. (NYSE:WD), and Installed Building Products Inc (NYSE:IBP). This group of stocks’ market values are similar to EPAY’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FG | 23 | 175870 | -1 |

| PTEN | 26 | 251357 | 1 |

| WD | 15 | 72221 | 0 |

| IBP | 20 | 189032 | 7 |

| Average | 21 | 172120 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $172 million. That figure was $85 million in EPAY’s case. Patterson-UTI Energy, Inc. (NASDAQ:PTEN) is the most popular stock in this table. On the other hand Walker & Dunlop Inc. (NYSE:WD) is the least popular one with only 15 bullish hedge fund positions. Bottomline Technologies (de), Inc. (NASDAQ:EPAY) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on EPAY as the stock returned 25.8% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.