Does Black Hills Corporation (NYSE:BKH) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

Black Hills Corporation (NYSE:BKH) investors should be aware of an increase in activity from the world’s largest hedge funds recently. Our calculations also showed that BKH isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s go over the fresh hedge fund action regarding Black Hills Corporation (NYSE:BKH).

How are hedge funds trading Black Hills Corporation (NYSE:BKH)?

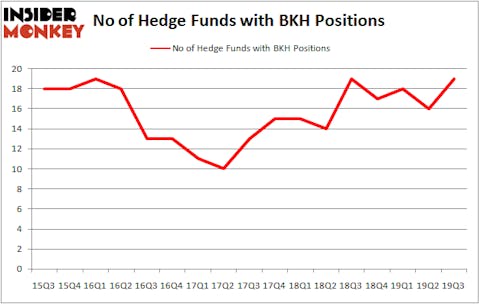

At the end of the third quarter, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 19% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in BKH over the last 17 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Black Hills Corporation (NYSE:BKH), with a stake worth $106.6 million reported as of the end of September. Trailing Renaissance Technologies was AQR Capital Management, which amassed a stake valued at $24.9 million. GAMCO Investors, D E Shaw, and Shelter Harbor Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Shelter Harbor Advisors allocated the biggest weight to Black Hills Corporation (NYSE:BKH), around 3.88% of its 13F portfolio. Huber Capital Management is also relatively very bullish on the stock, earmarking 0.22 percent of its 13F equity portfolio to BKH.

As one would reasonably expect, specific money managers have been driving this bullishness. Winton Capital Management, managed by David Harding, assembled the most valuable position in Black Hills Corporation (NYSE:BKH). Winton Capital Management had $2.5 million invested in the company at the end of the quarter. Alec Litowitz and Ross Laser’s Magnetar Capital also made a $1.4 million investment in the stock during the quarter. The other funds with brand new BKH positions are Michael Gelband’s ExodusPoint Capital, Donald Sussman’s Paloma Partners, and Peter Algert and Kevin Coldiron’s Algert Coldiron Investors.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Black Hills Corporation (NYSE:BKH) but similarly valued. We will take a look at Essent Group Ltd (NYSE:ESNT), Penumbra Inc (NYSE:PEN), Air Lease Corp (NYSE:AL), and Highwoods Properties Inc (NYSE:HIW). This group of stocks’ market valuations are closest to BKH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ESNT | 23 | 301615 | -7 |

| PEN | 23 | 374880 | 4 |

| AL | 23 | 442179 | 5 |

| HIW | 20 | 220525 | 7 |

| Average | 22.25 | 334800 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $335 million. That figure was $187 million in BKH’s case. Essent Group Ltd (NYSE:ESNT) is the most popular stock in this table. On the other hand Highwoods Properties Inc (NYSE:HIW) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Black Hills Corporation (NYSE:BKH) is even less popular than HIW. Hedge funds dodged a bullet by taking a bearish stance towards BKH. Our calculations showed that the top 20 most popular hedge fund stocks returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately BKH wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); BKH investors were disappointed as the stock returned 0.5% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.