A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended June 28, so let’s proceed with the discussion of the hedge fund sentiment on Bio-Techne Corporation (NASDAQ:TECH).

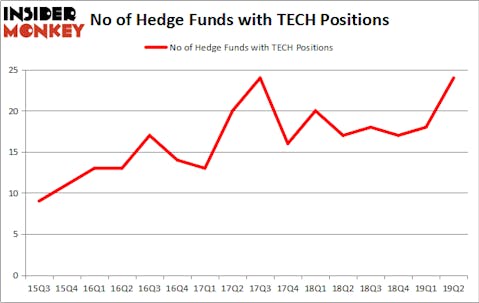

Bio-Techne Corporation (NASDAQ:TECH) was in 24 hedge funds’ portfolios at the end of the second quarter of 2019. TECH investors should pay attention to an increase in support from the world’s most elite money managers of late. There were 18 hedge funds in our database with TECH holdings at the end of the previous quarter. Our calculations also showed that TECH isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s go over the new hedge fund action regarding Bio-Techne Corporation (NASDAQ:TECH).

How have hedgies been trading Bio-Techne Corporation (NASDAQ:TECH)?

At Q2’s end, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 33% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in TECH over the last 16 quarters. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Bio-Techne Corporation (NASDAQ:TECH), which was worth $98.5 million at the end of the second quarter. On the second spot was 12 West Capital Management which amassed $74.3 million worth of shares. Moreover, Royce & Associates, AQR Capital Management, and Millennium Management were also bullish on Bio-Techne Corporation (NASDAQ:TECH), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers have jumped into Bio-Techne Corporation (NASDAQ:TECH) headfirst. Tudor Investment Corp, managed by Paul Tudor Jones, created the most outsized position in Bio-Techne Corporation (NASDAQ:TECH). Tudor Investment Corp had $1.3 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also initiated a $0.8 million position during the quarter. The other funds with brand new TECH positions are Robert B. Gillam’s McKinley Capital Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s now review hedge fund activity in other stocks similar to Bio-Techne Corporation (NASDAQ:TECH). These stocks are RPM International Inc. (NYSE:RPM), Hyatt Hotels Corporation (NYSE:H), RenaissanceRe Holdings Ltd. (NYSE:RNR), and Nordson Corporation (NASDAQ:NDSN). This group of stocks’ market values resemble TECH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RPM | 25 | 454818 | 4 |

| H | 23 | 846946 | -1 |

| RNR | 20 | 720820 | 0 |

| NDSN | 17 | 47469 | 4 |

| Average | 21.25 | 517513 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.25 hedge funds with bullish positions and the average amount invested in these stocks was $518 million. That figure was $353 million in TECH’s case. RPM International Inc. (NYSE:RPM) is the most popular stock in this table. On the other hand Nordson Corporation (NASDAQ:NDSN) is the least popular one with only 17 bullish hedge fund positions. Bio-Techne Corporation (NASDAQ:TECH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately TECH wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on TECH were disappointed as the stock returned -6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.