Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

Hedge fund interest in Atlassian Corporation Plc (NASDAQ:TEAM) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare TEAM to other stocks including General Mills, Inc. (NYSE:GIS), IQVIA Holdings, Inc. (NYSE:IQV), and HP Inc. (NYSE:HPQ) to get a better sense of its popularity. Our calculations also showed that TEAM isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are many metrics stock market investors can use to size up their holdings. A couple of the less utilized metrics are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the elite fund managers can outperform the S&P 500 by a significant amount (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s go over the recent hedge fund action encompassing Atlassian Corporation Plc (NASDAQ:TEAM).

What have hedge funds been doing with Atlassian Corporation Plc (NASDAQ:TEAM)?

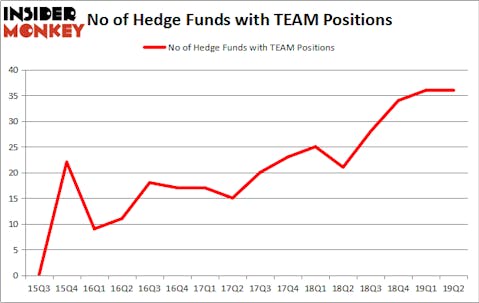

At the end of the second quarter, a total of 36 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 21 hedge funds with a bullish position in TEAM a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies has the most valuable position in Atlassian Corporation Plc (NASDAQ:TEAM), worth close to $602.9 million, corresponding to 0.5% of its total 13F portfolio. Coming in second is Tybourne Capital Management, managed by Eashwar Krishnan, which holds a $271 million position; 9.6% of its 13F portfolio is allocated to the company. Other peers with similar optimism contain D. E. Shaw’s D E Shaw, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and John Overdeck and David Siegel’s Two Sigma Advisors.

Because Atlassian Corporation Plc (NASDAQ:TEAM) has experienced bearish sentiment from hedge fund managers, we can see that there lies a certain “tier” of money managers who were dropping their full holdings heading into Q3. At the top of the heap, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital dropped the largest stake of the 750 funds tracked by Insider Monkey, valued at close to $5 million in stock, and David Costen Haley’s HBK Investments was right behind this move, as the fund dropped about $3.2 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Atlassian Corporation Plc (NASDAQ:TEAM) but similarly valued. We will take a look at General Mills, Inc. (NYSE:GIS), IQVIA Holdings, Inc. (NYSE:IQV), HP Inc. (NYSE:HPQ), and Canadian Natural Resources Limited (NYSE:CNQ). This group of stocks’ market valuations are closest to TEAM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GIS | 39 | 1025933 | 7 |

| IQV | 67 | 5892581 | 3 |

| HPQ | 32 | 870489 | -3 |

| CNQ | 24 | 424540 | -5 |

| Average | 40.5 | 2053386 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 40.5 hedge funds with bullish positions and the average amount invested in these stocks was $2053 million. That figure was $1997 million in TEAM’s case. IQVIA Holdings, Inc. (NYSE:IQV) is the most popular stock in this table. On the other hand Canadian Natural Resources Limited (NYSE:CNQ) is the least popular one with only 24 bullish hedge fund positions. Atlassian Corporation Plc (NASDAQ:TEAM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately TEAM wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); TEAM investors were disappointed as the stock returned -4.1% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.