Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 9 months of this year through September 30th the Standard and Poor’s 500 Index returned approximately 20% (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 24% during the same 9-month period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like Athenex, Inc. (NASDAQ:ATNX).

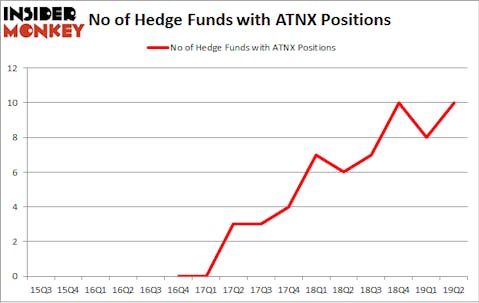

Is Athenex, Inc. (NASDAQ:ATNX) a healthy stock for your portfolio? Prominent investors are in an optimistic mood. The number of bullish hedge fund positions increased by 2 recently. Our calculations also showed that ATNX isn’t among the 30 most popular stocks among hedge funds (see the video below). ATNX was in 10 hedge funds’ portfolios at the end of the second quarter of 2019. There were 8 hedge funds in our database with ATNX positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are dozens of signals stock traders use to analyze stocks. A duo of the most useful signals are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the elite investment managers can trounce the S&P 500 by a superb amount (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s analyze the recent hedge fund action encompassing Athenex, Inc. (NASDAQ:ATNX).

What have hedge funds been doing with Athenex, Inc. (NASDAQ:ATNX)?

Heading into the third quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ATNX over the last 16 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

Among these funds, Perceptive Advisors held the most valuable stake in Athenex, Inc. (NASDAQ:ATNX), which was worth $187.6 million at the end of the second quarter. On the second spot was venBio Select Advisor which amassed $91.2 million worth of shares. Moreover, OrbiMed Advisors, Deerfield Management, and Kingdon Capital were also bullish on Athenex, Inc. (NASDAQ:ATNX), allocating a large percentage of their portfolios to this stock.

Now, key hedge funds were breaking ground themselves. venBio Select Advisor, managed by Behzad Aghazadeh, initiated the most outsized position in Athenex, Inc. (NASDAQ:ATNX). venBio Select Advisor had $91.2 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $8.8 million position during the quarter. The other funds with new positions in the stock are Steve Cohen’s Point72 Asset Management, D. E. Shaw’s D E Shaw, and Ken Griffin’s Citadel Investment Group.

Let’s go over hedge fund activity in other stocks similar to Athenex, Inc. (NASDAQ:ATNX). These stocks are Bloom Energy Corporation (NYSE:BE), Cray Inc. (NASDAQ:CRAY), Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA), and Inogen Inc (NASDAQ:INGN). This group of stocks’ market values are similar to ATNX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BE | 11 | 29807 | 2 |

| CRAY | 25 | 167546 | 6 |

| LOMA | 14 | 16776 | 7 |

| INGN | 18 | 149739 | 1 |

| Average | 17 | 90967 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $91 million. That figure was $396 million in ATNX’s case. Cray Inc. (NASDAQ:CRAY) is the most popular stock in this table. On the other hand Bloom Energy Corporation (NYSE:BE) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Athenex, Inc. (NASDAQ:ATNX) is even less popular than BE. Hedge funds dodged a bullet by taking a bearish stance towards ATNX. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately ATNX wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); ATNX investors were disappointed as the stock returned -38.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.