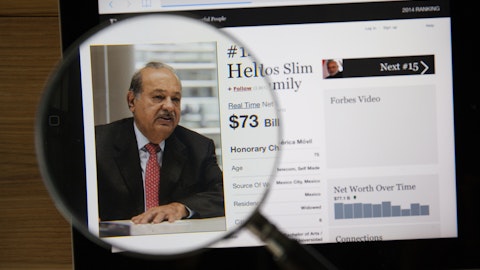

Before we spend days researching a stock idea we like to take a look at how hedge funds and billionaire investors recently traded that stock. The S&P 500 Index ETF (SPY) lost 2.6% in the first two months of the second quarter. Ten out of 11 industry groups in the S&P 500 Index lost value in May. The average return of a randomly picked stock in the index was even worse (-3.6%). This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 20 most popular S&P 500 stocks among hedge funds not only generated positive returns but also outperformed the index by about 3 percentage points through May 30th. In this article, we will take a look at what hedge funds think about America Movil SAB de CV (NYSE:AMX).

Is America Movil SAB de CV (NYSE:AMX) the right investment to pursue these days? Prominent investors are in a bullish mood. The number of long hedge fund positions went up by 2 lately. Our calculations also showed that amx isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Noam Gottesman, GLG Partners

We’re going to analyze the latest hedge fund action encompassing America Movil SAB de CV (NYSE:AMX).

Hedge fund activity in America Movil SAB de CV (NYSE:AMX)

At the end of the first quarter, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from one quarter earlier. By comparison, 8 hedge funds held shares or bullish call options in AMX a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in America Movil SAB de CV (NYSE:AMX) was held by Fisher Asset Management, which reported holding $169.7 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $18.6 million position. Other investors bullish on the company included GLG Partners, Millennium Management, and Citadel Investment Group.

Now, key hedge funds were breaking ground themselves. Islet Management, managed by Joseph Samuels, established the most valuable position in America Movil SAB de CV (NYSE:AMX). Islet Management had $2.2 million invested in the company at the end of the quarter. Mike Vranos’s Ellington also made a $0.5 million investment in the stock during the quarter. The following funds were also among the new AMX investors: Dmitry Balyasny’s Balyasny Asset Management and Michael Gelband’s ExodusPoint Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as America Movil SAB de CV (NYSE:AMX) but similarly valued. We will take a look at Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX), Illinois Tool Works Inc. (NYSE:ITW), UBS Group AG (NYSE:UBS), and Biogen Inc. (NASDAQ:BIIB). All of these stocks’ market caps resemble AMX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VRTX | 45 | 2285930 | 6 |

| ITW | 27 | 315022 | -1 |

| UBS | 11 | 750775 | 0 |

| BIIB | 49 | 2936721 | -8 |

| Average | 33 | 1572112 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33 hedge funds with bullish positions and the average amount invested in these stocks was $1572 million. That figure was $234 million in AMX’s case. Biogen Inc. (NASDAQ:BIIB) is the most popular stock in this table. On the other hand UBS Group AG (NYSE:UBS) is the least popular one with only 11 bullish hedge fund positions. America Movil SAB de CV (NYSE:AMX) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on AMX, though not to the same extent, as the stock returned 4.5% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.