Is Ameresco Inc (NYSE:AMRC) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

Ameresco Inc (NYSE:AMRC) has seen an increase in support from the world’s most elite money managers recently. Our calculations also showed that AMRC isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a lot of gauges market participants employ to appraise their holdings. A duo of the most underrated gauges are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the top money managers can outperform the S&P 500 by a significant margin (see the details here).

We’re going to take a glance at the new hedge fund action surrounding Ameresco Inc (NYSE:AMRC).

What have hedge funds been doing with Ameresco Inc (NYSE:AMRC)?

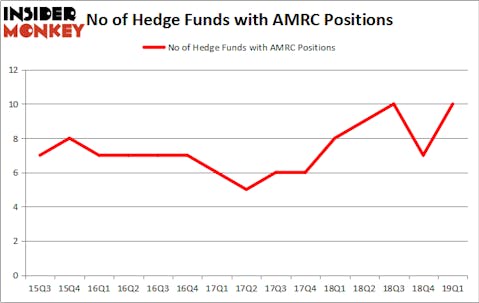

At the end of the first quarter, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 43% from the previous quarter. The graph below displays the number of hedge funds with bullish position in AMRC over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Ameresco Inc (NYSE:AMRC) was held by Royce & Associates, which reported holding $11.8 million worth of stock at the end of March. It was followed by Bandera Partners with a $6.5 million position. Other investors bullish on the company included Driehaus Capital, Renaissance Technologies, and Marshall Wace LLP.

As one would reasonably expect, key money managers were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, assembled the most outsized position in Ameresco Inc (NYSE:AMRC). Marshall Wace LLP had $1.8 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $0.6 million position during the quarter. The only other fund with a new position in the stock is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now review hedge fund activity in other stocks similar to Ameresco Inc (NYSE:AMRC). We will take a look at Oritani Financial Corp. (NASDAQ:ORIT), Meridian Bioscience, Inc. (NASDAQ:VIVO), Wabash National Corporation (NYSE:WNC), and NV5 Global, Inc. (NASDAQ:NVEE). This group of stocks’ market valuations match AMRC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ORIT | 7 | 36842 | -1 |

| VIVO | 16 | 83869 | -2 |

| WNC | 16 | 67949 | -4 |

| NVEE | 10 | 25194 | -3 |

| Average | 12.25 | 53464 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $53 million. That figure was $31 million in AMRC’s case. Meridian Bioscience, Inc. (NASDAQ:VIVO) is the most popular stock in this table. On the other hand Oritani Financial Corp. (NASDAQ:ORIT) is the least popular one with only 7 bullish hedge fund positions. Ameresco Inc (NYSE:AMRC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately AMRC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); AMRC investors were disappointed as the stock returned -11.1% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.