We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (10 coronavirus predictions).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind, let’s take a look at whether Alteryx, Inc. (NYSE:AYX) is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

Hedge fund interest in Alteryx, Inc. (NYSE:AYX) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Mellanox Technologies, Ltd. (NASDAQ:MLNX), ITT Corp (NYSE:ITT), and Proofpoint Inc (NASDAQ:PFPT) to gather more data points. Our calculations also showed that AYX isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Colin Moran of Abdiel Capital Advisors

We leave no stone unturned when looking for the next great investment idea. For example we recently identified a stock that trades 25% below the net cash on its balance sheet. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to take a glance at the recent hedge fund action regarding Alteryx, Inc. (NYSE:AYX).

How have hedgies been trading Alteryx, Inc. (NYSE:AYX)?

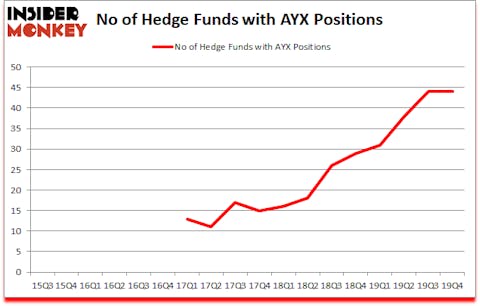

Heading into the first quarter of 2020, a total of 44 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in AYX over the last 18 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Colin Moran’s Abdiel Capital Advisors has the biggest position in Alteryx, Inc. (NYSE:AYX), worth close to $356.7 million, corresponding to 22.3% of its total 13F portfolio. The second most bullish fund manager is Alkeon Capital Management, managed by Panayotis Takis Sparaggis, which holds a $130.3 million position; 0.5% of its 13F portfolio is allocated to the company. Other professional money managers that are bullish contain Alex Sacerdote’s Whale Rock Capital Management, Brian Ashford-Russell and Tim Woolley’s Polar Capital and Keith Meister’s Corvex Capital. In terms of the portfolio weights assigned to each position Abdiel Capital Advisors allocated the biggest weight to Alteryx, Inc. (NYSE:AYX), around 22.29% of its 13F portfolio. Center Lake Capital is also relatively very bullish on the stock, earmarking 8.88 percent of its 13F equity portfolio to AYX.

Judging by the fact that Alteryx, Inc. (NYSE:AYX) has experienced bearish sentiment from hedge fund managers, we can see that there was a specific group of hedge funds that decided to sell off their full holdings last quarter. Intriguingly, John Overdeck and David Siegel’s Two Sigma Advisors dropped the largest investment of all the hedgies watched by Insider Monkey, valued at about $28.8 million in stock. James Crichton’s fund, Hitchwood Capital Management, also said goodbye to its stock, about $13.4 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Alteryx, Inc. (NYSE:AYX). We will take a look at Mellanox Technologies, Ltd. (NASDAQ:MLNX), ITT Corp (NYSE:ITT), Proofpoint Inc (NASDAQ:PFPT), and Morningstar, Inc. (NASDAQ:MORN). This group of stocks’ market values are closest to AYX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MLNX | 39 | 1468992 | -3 |

| ITT | 28 | 756797 | 3 |

| PFPT | 35 | 395274 | -10 |

| MORN | 21 | 286273 | -4 |

| Average | 30.75 | 726834 | -3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.75 hedge funds with bullish positions and the average amount invested in these stocks was $727 million. That figure was $961 million in AYX’s case. Mellanox Technologies, Ltd. (NASDAQ:MLNX) is the most popular stock in this table. On the other hand Morningstar, Inc. (NASDAQ:MORN) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks Alteryx, Inc. (NYSE:AYX) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 22.3% in 2020 through March 16th but still managed to beat the market by 3.2 percentage points. Hedge funds were also right about betting on AYX as the stock returned -19.1% so far in Q1 (through March 16th) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.