A market surge in the first quarter, spurred by easing global macroeconomic concerns and Powell’s pivot ended up having a positive impact on the markets and many hedge funds as a result. The stocks of smaller companies which were especially hard hit during the fourth quarter slightly outperformed the market during the first quarter. Unfortunately, Trump is unpredictable and volatility returned in the second quarter and smaller-cap stocks went back to selling off. We finished compiling the latest 13F filings to get an idea about what hedge funds are thinking about the overall market as well as individual stocks. In this article we will study the hedge fund sentiment to see how those concerns affected their ownership of Albireo Pharma, Inc. (NASDAQ:ALBO) during the quarter.

Albireo Pharma, Inc. (NASDAQ:ALBO) has seen an increase in activity from the world’s largest hedge funds of late. Our calculations also showed that ALBO isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are seen as underperforming, outdated financial vehicles of the past. While there are greater than 8000 funds in operation at the moment, Our experts choose to focus on the elite of this group, approximately 750 funds. Most estimates calculate that this group of people shepherd most of the hedge fund industry’s total capital, and by tracking their best stock picks, Insider Monkey has unsheathed many investment strategies that have historically outperformed Mr. Market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s review the fresh hedge fund action regarding Albireo Pharma, Inc. (NASDAQ:ALBO).

What have hedge funds been doing with Albireo Pharma, Inc. (NASDAQ:ALBO)?

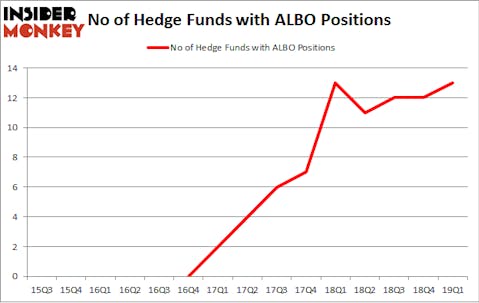

Heading into the second quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in ALBO over the last 15 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Albireo Pharma, Inc. (NASDAQ:ALBO) was held by Perceptive Advisors, which reported holding $54.9 million worth of stock at the end of March. It was followed by Prosight Capital with a $8.7 million position. Other investors bullish on the company included Baker Bros. Advisors, Sectoral Asset Management, and Biotechnology Value Fund / BVF Inc.

As industrywide interest jumped, some big names have been driving this bullishness. GLG Partners, managed by Noam Gottesman, established the most valuable position in Albireo Pharma, Inc. (NASDAQ:ALBO). GLG Partners had $0.7 million invested in the company at the end of the quarter.

Let’s go over hedge fund activity in other stocks similar to Albireo Pharma, Inc. (NASDAQ:ALBO). We will take a look at Tekla Life Sciences Investors (NYSE:HQL), Tekla World Healthcare Fund (NYSE:THW), Altisource Portfolio Solutions S.A. (NASDAQ:ASPS), and Gritstone Oncology, Inc. (NASDAQ:GRTS). This group of stocks’ market caps are closest to ALBO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HQL | 2 | 678 | 0 |

| THW | 1 | 283 | 0 |

| ASPS | 10 | 33161 | -1 |

| GRTS | 8 | 83888 | -1 |

| Average | 5.25 | 29503 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.25 hedge funds with bullish positions and the average amount invested in these stocks was $30 million. That figure was $95 million in ALBO’s case. Altisource Portfolio Solutions S.A. (NASDAQ:ASPS) is the most popular stock in this table. On the other hand Tekla World Healthcare Fund (NYSE:THW) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Albireo Pharma, Inc. (NASDAQ:ALBO) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately ALBO wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ALBO were disappointed as the stock returned -0.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.