We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended December 31, so let’s proceed with the discussion of the hedge fund sentiment on Alamos Gold Inc (NYSE:AGI).

Hedge fund interest in Alamos Gold Inc (NYSE:AGI) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Aurora Cannabis Inc. (NASDAQ:ACB), Washington Real Estate Investment Trust (NYSE:WRE), and Tenable Holdings, Inc. (NASDAQ:TENB) to gather more data points. Our calculations also showed that AGI isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

To most shareholders, hedge funds are viewed as slow, outdated investment tools of years past. While there are over 8000 funds in operation today, We hone in on the top tier of this club, approximately 850 funds. These investment experts manage the lion’s share of the smart money’s total asset base, and by paying attention to their matchless equity investments, Insider Monkey has deciphered many investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Chuck Royce of Royce & Associates

Now we’re going to view the key hedge fund action surrounding Alamos Gold Inc (NYSE:AGI).

How have hedgies been trading Alamos Gold Inc (NYSE:AGI)?

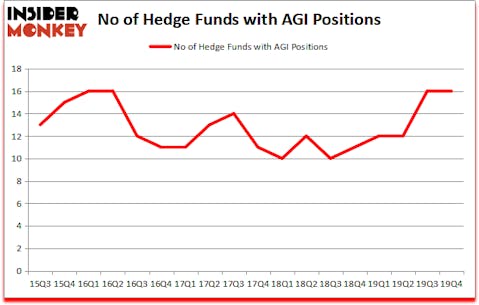

Heading into the first quarter of 2020, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. By comparison, 11 hedge funds held shares or bullish call options in AGI a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Alamos Gold Inc (NYSE:AGI) was held by Renaissance Technologies, which reported holding $75.2 million worth of stock at the end of September. It was followed by Arrowstreet Capital with a $41.5 million position. Other investors bullish on the company included Sun Valley Gold, Royce & Associates, and Polar Capital. In terms of the portfolio weights assigned to each position Sun Valley Gold allocated the biggest weight to Alamos Gold Inc (NYSE:AGI), around 2.68% of its 13F portfolio. Sprott Asset Management is also relatively very bullish on the stock, designating 0.8 percent of its 13F equity portfolio to AGI.

Judging by the fact that Alamos Gold Inc (NYSE:AGI) has witnessed a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there is a sect of hedge funds that elected to cut their entire stakes heading into Q4. It’s worth mentioning that Mark Travis’s Intrepid Capital Management cut the biggest stake of the “upper crust” of funds monitored by Insider Monkey, comprising an estimated $0.6 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also cut its stock, about $0.4 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Alamos Gold Inc (NYSE:AGI). We will take a look at Aurora Cannabis Inc. (NYSE:ACB), Washington Real Estate Investment Trust (NYSE:WRE), Tenable Holdings, Inc. (NASDAQ:TENB), and PQ Group Holdings Inc. (NYSE:PQG). All of these stocks’ market caps are closest to AGI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ACB | 12 | 19142 | 1 |

| WRE | 9 | 128480 | 4 |

| TENB | 22 | 210963 | 3 |

| PQG | 4 | 55625 | -4 |

| Average | 11.75 | 103553 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $104 million. That figure was $241 million in AGI’s case. Tenable Holdings, Inc. (NASDAQ:TENB) is the most popular stock in this table. On the other hand PQ Group Holdings Inc. (NYSE:PQG) is the least popular one with only 4 bullish hedge fund positions. Alamos Gold Inc (NYSE:AGI) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 13.0% in 2020 through April 6th but still beat the market by 4.2 percentage points. Hedge funds were also right about betting on AGI as the stock returned -3.4% in 2020 (through April 6th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.