Insider Monkey finished processing more than 700 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of December 31st, 2018. In this article we are going to take a look at smart money sentiment towards ACCO Brands Corporation (NYSE:ACCO).

ACCO Brands Corporation (NYSE:ACCO) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 21 hedge funds’ portfolios at the end of December. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Bryn Mawr Bank Corp. (NASDAQ:BMTC), Tidewater Inc. (NYSE:TDW), and Y-mAbs Therapeutics, Inc. (NASDAQ:YMAB) to gather more data points.

If you’d ask most shareholders, hedge funds are viewed as unimportant, old financial tools of the past. While there are over 8000 funds trading at the moment, We choose to focus on the masters of this club, about 750 funds. These hedge fund managers handle the lion’s share of the smart money’s total capital, and by tracking their top stock picks, Insider Monkey has figured out many investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a gander at the recent hedge fund action regarding ACCO Brands Corporation (NYSE:ACCO).

What have hedge funds been doing with ACCO Brands Corporation (NYSE:ACCO)?

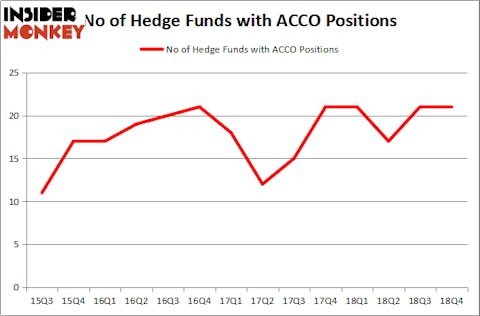

Heading into the first quarter of 2019, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ACCO over the last 14 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Among these funds, D E Shaw held the most valuable stake in ACCO Brands Corporation (NYSE:ACCO), which was worth $12.5 million at the end of the fourth quarter. On the second spot was Ancora Advisors which amassed $4.7 million worth of shares. Moreover, AQR Capital Management, Arrowstreet Capital, and Marshall Wace LLP were also bullish on ACCO Brands Corporation (NYSE:ACCO), allocating a large percentage of their portfolios to this stock.

Because ACCO Brands Corporation (NYSE:ACCO) has witnessed falling interest from the entirety of the hedge funds we track, it’s safe to say that there is a sect of money managers who were dropping their full holdings last quarter. At the top of the heap, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital cut the largest investment of all the hedgies monitored by Insider Monkey, comprising close to $1 million in stock, and Noam Gottesman’s GLG Partners was right behind this move, as the fund said goodbye to about $1 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to ACCO Brands Corporation (NYSE:ACCO). We will take a look at Bryn Mawr Bank Corp. (NASDAQ:BMTC), Tidewater Inc. (NYSE:TDW), Y-mAbs Therapeutics, Inc. (NASDAQ:YMAB), and FutureFuel Corp. (NYSE:FF). This group of stocks’ market caps match ACCO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BMTC | 8 | 37812 | -1 |

| TDW | 14 | 176770 | 3 |

| YMAB | 6 | 51844 | -5 |

| FF | 14 | 57050 | 3 |

| Average | 10.5 | 80869 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $81 million. That figure was $36 million in ACCO’s case. Tidewater Inc. (NYSE:TDW) is the most popular stock in this table. On the other hand Y-mAbs Therapeutics, Inc. (NASDAQ:YMAB) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks ACCO Brands Corporation (NYSE:ACCO) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on ACCO as the stock returned 27.1% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.