You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

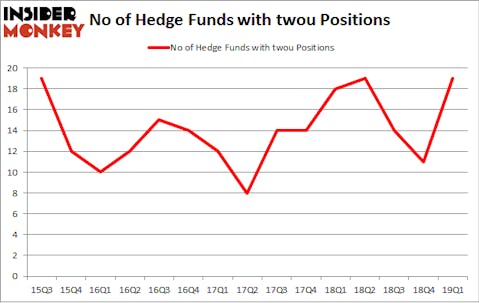

Is 2U Inc (NASDAQ:TWOU) going to take off soon? Investors who are in the know are getting more bullish. The number of bullish hedge fund bets increased by 8 recently. Our calculations also showed that twou isn’t among the 30 most popular stocks among hedge funds. TWOU was in 19 hedge funds’ portfolios at the end of March. There were 11 hedge funds in our database with TWOU holdings at the end of the previous quarter.

In the 21st century investor’s toolkit there are tons of metrics market participants use to grade publicly traded companies. A couple of the most underrated metrics are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the elite hedge fund managers can beat the S&P 500 by a very impressive amount (see the details here).

Let’s take a look at the latest hedge fund action surrounding 2U Inc (NASDAQ:TWOU).

Hedge fund activity in 2U Inc (NASDAQ:TWOU)

At Q1’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 73% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards TWOU over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Brian Ashford-Russell and Tim Woolley’s Polar Capital has the biggest position in 2U Inc (NASDAQ:TWOU), worth close to $35.4 million, comprising 0.3% of its total 13F portfolio. Coming in second is Bruce Emery of Greenvale Capital, with a $32.5 million position; 8.7% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors that hold long positions comprise D. E. Shaw’s D E Shaw, Genevieve Kahr’s Ailanthus Capital Management and George McCabe’s Portolan Capital Management.

Now, key money managers have been driving this bullishness. Ailanthus Capital Management, managed by Genevieve Kahr, initiated the biggest position in 2U Inc (NASDAQ:TWOU). Ailanthus Capital Management had $19.8 million invested in the company at the end of the quarter. Marcelo Desio’s Lucha Capital Management also initiated a $11.7 million position during the quarter. The following funds were also among the new TWOU investors: James Thomas Berylson’s Berylson Capital Partners, John Overdeck and David Siegel’s Two Sigma Advisors, and Mike Vranos’s Ellington.

Let’s also examine hedge fund activity in other stocks similar to 2U Inc (NASDAQ:TWOU). We will take a look at The Wendy’s Company (NASDAQ:WEN), Jabil Inc. (NYSE:JBL), Emcor Group Inc (NYSE:EME), and Rayonier Inc. (NYSE:RYN). This group of stocks’ market valuations are similar to TWOU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WEN | 27 | 914054 | 1 |

| JBL | 20 | 275454 | 0 |

| EME | 26 | 248543 | 8 |

| RYN | 14 | 318375 | -5 |

| Average | 21.75 | 439107 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $439 million. That figure was $155 million in TWOU’s case. The Wendy’s Company (NASDAQ:WEN) is the most popular stock in this table. On the other hand Rayonier Inc. (NYSE:RYN) is the least popular one with only 14 bullish hedge fund positions. 2U Inc (NASDAQ:TWOU) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately TWOU wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); TWOU investors were disappointed as the stock returned -46% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.