Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Shell Midstream Partners LP (NYSE:SHLX).

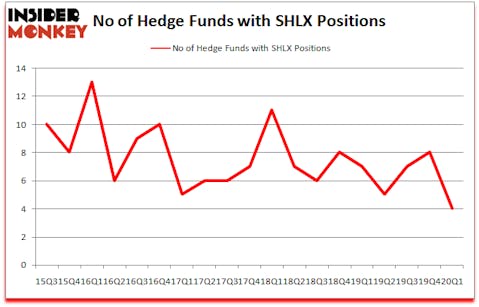

Shell Midstream Partners LP (NYSE:SHLX) was in 4 hedge funds’ portfolios at the end of March. SHLX has seen a decrease in support from the world’s most elite money managers in recent months. There were 8 hedge funds in our database with SHLX positions at the end of the previous quarter. Our calculations also showed that SHLX isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 44 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 36% through May 18th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, legendary investor Bill Miller told investors to sell 7 extremely popular recession stocks last month. So, we went through his list and recommended another stock with 100% upside potential instead. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s review the new hedge fund action surrounding Shell Midstream Partners LP (NYSE:SHLX).

What have hedge funds been doing with Shell Midstream Partners LP (NYSE:SHLX)?

Heading into the second quarter of 2020, a total of 4 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -50% from the fourth quarter of 2019. The graph below displays the number of hedge funds with bullish position in SHLX over the last 18 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the most valuable position in Shell Midstream Partners LP (NYSE:SHLX), worth close to $12.1 million, accounting for less than 0.1%% of its total 13F portfolio. The second most bullish fund manager is PEAK6 Capital Management, managed by Matthew Hulsizer, which holds a $0.5 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Other professional money managers that hold long positions comprise Ken Griffin’s Citadel Investment Group, Russell Lucas’s Lucas Capital Management and Ken Griffin’s Citadel Investment Group. In terms of the portfolio weights assigned to each position Lucas Capital Management allocated the biggest weight to Shell Midstream Partners LP (NYSE:SHLX), around 0.39% of its 13F portfolio. Arrowstreet Capital is also relatively very bullish on the stock, dishing out 0.03 percent of its 13F equity portfolio to SHLX.

Judging by the fact that Shell Midstream Partners LP (NYSE:SHLX) has witnessed a decline in interest from hedge fund managers, it’s easy to see that there lies a certain “tier” of money managers who were dropping their entire stakes by the end of the third quarter. Intriguingly, T Boone Pickens’s BP Capital dropped the largest investment of all the hedgies watched by Insider Monkey, totaling about $4 million in stock, and Renaissance Technologies was right behind this move, as the fund said goodbye to about $1 million worth. These moves are intriguing to say the least, as total hedge fund interest dropped by 4 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Shell Midstream Partners LP (NYSE:SHLX) but similarly valued. We will take a look at Thor Industries, Inc. (NYSE:THO), Arco Platform Limited (NASDAQ:ARCE), Premier Inc (NASDAQ:PINC), and Kinsale Capital Group, Inc. (NASDAQ:KNSL). All of these stocks’ market caps resemble SHLX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| THO | 20 | 80400 | -10 |

| ARCE | 16 | 144545 | -1 |

| PINC | 17 | 190749 | 3 |

| KNSL | 7 | 24342 | -4 |

| Average | 15 | 110009 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $110 million. That figure was $13 million in SHLX’s case. Thor Industries, Inc. (NYSE:THO) is the most popular stock in this table. On the other hand Kinsale Capital Group, Inc. (NASDAQ:KNSL) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Shell Midstream Partners LP (NYSE:SHLX) is even less popular than KNSL. Hedge funds clearly dropped the ball on SHLX as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May and still beat the market by 13.2 percentage points. A small number of hedge funds were also right about betting on SHLX as the stock returned 39.9% so far in the second quarter and outperformed the market by an even larger margin.

Follow Shell Midstream Partners L.p. (NYSE:SHLX)

Follow Shell Midstream Partners L.p. (NYSE:SHLX)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.