The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their September 30 holdings, data that is available nowhere else. Should you consider J. Jill, Inc. (NYSE:JILL) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

Is J. Jill, Inc. (NYSE:JILL) an attractive investment right now? The smart money is in a bearish mood. The number of bullish hedge fund bets went down by 2 lately. Our calculations also showed that JILL isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are dozens of methods stock market investors use to grade their stock investments. A couple of the most underrated methods are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the elite hedge fund managers can trounce the broader indices by a healthy margin (see the details here).

David Harding of Winton Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Now let’s go over the key hedge fund action surrounding J. Jill, Inc. (NYSE:JILL).

What have hedge funds been doing with J. Jill, Inc. (NYSE:JILL)?

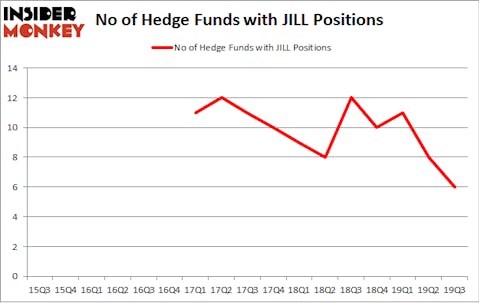

Heading into the fourth quarter of 2019, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -25% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in JILL over the last 17 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

Among these funds, Arrowstreet Capital held the most valuable stake in J. Jill, Inc. (NYSE:JILL), which was worth $0.9 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $0.5 million worth of shares. Millennium Management, Winton Capital Management, and Two Sigma Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Arrowstreet Capital allocated the biggest weight to J. Jill, Inc. (NYSE:JILL), around 0.0021% of its 13F portfolio. Winton Capital Management is also relatively very bullish on the stock, designating 0.0021 percent of its 13F equity portfolio to JILL.

Because J. Jill, Inc. (NYSE:JILL) has faced declining sentiment from hedge fund managers, it’s easy to see that there exists a select few hedgies that elected to cut their positions entirely in the third quarter. At the top of the heap, Cliff Asness’s AQR Capital Management sold off the biggest investment of the “upper crust” of funds monitored by Insider Monkey, comprising close to $0.1 million in stock. William Michaelcheck’s fund, Mariner Investment Group, also dumped its stock, about $0.1 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 2 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks similar to J. Jill, Inc. (NYSE:JILL). These stocks are Destination XL Group Inc (NASDAQ:DXLG), VBI Vaccines, Inc. (NASDAQ:VBIV), Selecta Biosciences, Inc. (NASDAQ:SELB), and Postal Realty Trust, Inc. (NYSE:PSTL). This group of stocks’ market caps are closest to JILL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DXLG | 6 | 31087 | -1 |

| VBIV | 9 | 48310 | 6 |

| SELB | 9 | 14294 | 1 |

| PSTL | 7 | 20025 | -2 |

| Average | 7.75 | 28429 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.75 hedge funds with bullish positions and the average amount invested in these stocks was $28 million. That figure was $2 million in JILL’s case. VBI Vaccines, Inc. (NASDAQ:VBIV) is the most popular stock in this table. On the other hand Destination XL Group Inc (NASDAQ:DXLG) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks J. Jill, Inc. (NYSE:JILL) is even less popular than DXLG. Hedge funds dodged a bullet by taking a bearish stance towards JILL. Our calculations showed that the top 20 most popular hedge fund stocks returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately JILL wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); JILL investors were disappointed as the stock returned -8.4% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.