We are still in an overall bull market and many stocks that smart money investors were piling into surged through November 22nd. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 52% and 49% respectively. Hedge funds’ top 3 stock picks returned 39.1% this year and beat the S&P 500 ETFs by nearly 13 percentage points. That’s a big deal.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

Is Hudson Technologies, Inc. (NASDAQ:HDSN) a healthy stock for your portfolio? Prominent investors are in a pessimistic mood. The number of long hedge fund bets were cut by 1 lately. Our calculations also showed that HDSN isn’t among the 30 most popular stocks among hedge funds.

Today there are dozens of methods shareholders employ to size up stocks. A couple of the most under-the-radar methods are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the elite hedge fund managers can beat the broader indices by a very impressive amount (see the details here).

David Harding of Winton Capital Management

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a gander at the key hedge fund action encompassing Hudson Technologies, Inc. (NASDAQ:HDSN).

How have hedgies been trading Hudson Technologies, Inc. (NASDAQ:HDSN)?

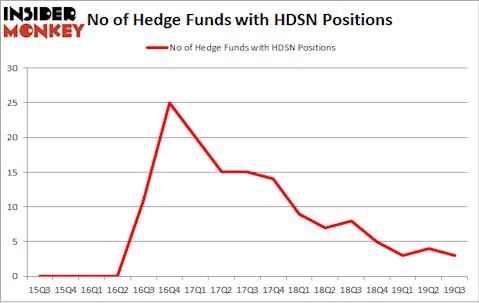

At the end of the third quarter, a total of 3 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -25% from the previous quarter. The graph below displays the number of hedge funds with bullish position in HDSN over the last 17 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

More specifically, Winton Capital Management was the largest shareholder of Hudson Technologies, Inc. (NASDAQ:HDSN), with a stake worth $0.5 million reported as of the end of September. Trailing Winton Capital Management was Royce & Associates, which amassed a stake valued at $0 million. Two Sigma Advisors was also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Winton Capital Management allocated the biggest weight to Hudson Technologies, Inc. (NASDAQ:HDSN), around 0.01% of its portfolio. Royce & Associates is also relatively very bullish on the stock, dishing out 0.0003 percent of its 13F equity portfolio to HDSN.

Judging by the fact that Hudson Technologies, Inc. (NASDAQ:HDSN) has witnessed a decline in interest from the smart money, it’s safe to say that there is a sect of hedge funds that slashed their entire stakes heading into Q4. At the top of the heap, Keith M. Rosenbloom’s Cruiser Capital Advisors sold off the largest investment of the “upper crust” of funds watched by Insider Monkey, worth about $0.2 million in stock. David E. Shaw’s fund, D E Shaw, also dropped its stock, about $0.1 million worth. These transactions are interesting, as total hedge fund interest dropped by 1 funds heading into Q4.

Let’s also examine hedge fund activity in other stocks similar to Hudson Technologies, Inc. (NASDAQ:HDSN). We will take a look at Envision Solar International, Inc. (NASDAQ:EVSI), Key Energy Services, Inc. (NYSE:KEG), Altimmune, Inc. (NASDAQ:ALT), and JAKKS Pacific, Inc. (NASDAQ:JAKK). This group of stocks’ market caps are closest to HDSN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EVSI | 3 | 1538 | 0 |

| KEG | 4 | 6430 | -4 |

| ALT | 4 | 303 | 1 |

| JAKK | 4 | 2798 | 0 |

| Average | 3.75 | 2767 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.75 hedge funds with bullish positions and the average amount invested in these stocks was $3 million. That figure was $1 million in HDSN’s case. Key Energy Services, Inc. (NYSE:KEG) is the most popular stock in this table. On the other hand Envision Solar International, Inc. (NASDAQ:EVSI) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Hudson Technologies, Inc. (NASDAQ:HDSN) is even less popular than EVSI. Hedge funds dodged a bullet by taking a bearish stance towards HDSN. Our calculations showed that the top 20 most popular hedge fund stocks returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately HDSN wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); HDSN investors were disappointed as the stock returned -21.1% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.