In this article you are going to find out whether hedge funds think Catasys, Inc. (NASDAQ:CATS) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

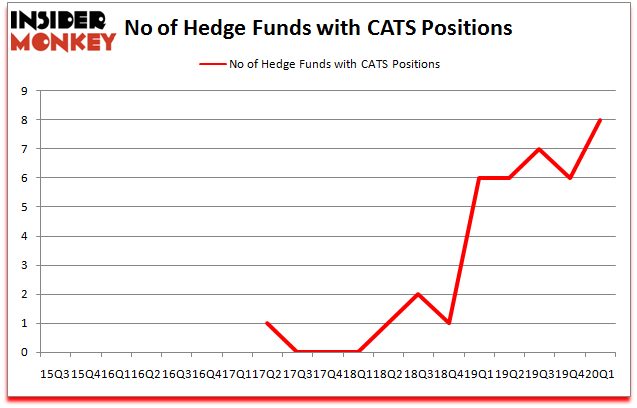

Is Catasys, Inc. (NASDAQ:CATS) a buy, sell, or hold? Investors who are in the know are turning bullish. The number of bullish hedge fund positions improved by 2 recently. Our calculations also showed that CATS isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are several gauges stock market investors have at their disposal to assess publicly traded companies. A couple of the less utilized gauges are hedge fund and insider trading moves. We have shown that, historically, those who follow the top picks of the best fund managers can trounce the market by a superb amount (see the details here).

Wilmot B. Harkey of Nantahala Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, We take a look at lists like the 10 most profitable companies in the world to identify the compounders that are likely to deliver double digit returns. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s take a look at the key hedge fund action regarding Catasys, Inc. (NASDAQ:CATS).

What have hedge funds been doing with Catasys, Inc. (NASDAQ:CATS)?

Heading into the second quarter of 2020, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a change of 33% from the previous quarter. By comparison, 6 hedge funds held shares or bullish call options in CATS a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Nantahala Capital Management, managed by Wilmot B. Harkey and Daniel Mack, holds the largest position in Catasys, Inc. (NASDAQ:CATS). Nantahala Capital Management has a $3 million position in the stock, comprising 0.1% of its 13F portfolio. The second most bullish fund manager is G2 Investment Partners Management, managed by Josh Goldberg, which holds a $1 million position; 0.3% of its 13F portfolio is allocated to the stock. Some other peers that hold long positions comprise Fred Knoll’s Knoll Capital Management, Israel Englander’s Millennium Management and D. E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Knoll Capital Management allocated the biggest weight to Catasys, Inc. (NASDAQ:CATS), around 0.62% of its 13F portfolio. G2 Investment Partners Management is also relatively very bullish on the stock, dishing out 0.33 percent of its 13F equity portfolio to CATS.

With a general bullishness amongst the heavyweights, key money managers were leading the bulls’ herd. Nantahala Capital Management, managed by Wilmot B. Harkey and Daniel Mack, established the biggest position in Catasys, Inc. (NASDAQ:CATS). Nantahala Capital Management had $3 million invested in the company at the end of the quarter. Josh Goldberg’s G2 Investment Partners Management also made a $1 million investment in the stock during the quarter. The following funds were also among the new CATS investors: D. E. Shaw’s D E Shaw and Ken Griffin’s Citadel Investment Group.

Let’s check out hedge fund activity in other stocks similar to Catasys, Inc. (NASDAQ:CATS). These stocks are Invacare Corporation (NYSE:IVC), Diamond Offshore Drilling Inc (NYSE:DO), Seres Therapeutics Inc (NASDAQ:MCRB), and Ellington Financial Inc. (NYSE:EFC). This group of stocks’ market values are similar to CATS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IVC | 19 | 62476 | 4 |

| DO | 10 | 30889 | -6 |

| MCRB | 4 | 6070 | -1 |

| EFC | 11 | 20301 | -1 |

| Average | 11 | 29934 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $30 million. That figure was $6 million in CATS’s case. Invacare Corporation (NYSE:IVC) is the most popular stock in this table. On the other hand Seres Therapeutics Inc (NASDAQ:MCRB) is the least popular one with only 4 bullish hedge fund positions. Catasys, Inc. (NASDAQ:CATS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.2% in 2020 through June 17th and still beat the market by 14.8 percentage points. A small number of hedge funds were also right about betting on CATS as the stock returned 39.1% during the second quarter and outperformed the market by an even larger margin.

Follow Ontrak Inc. (NASDAQ:OTRK)

Follow Ontrak Inc. (NASDAQ:OTRK)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.