At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards 8×8, Inc. (NASDAQ:EGHT).

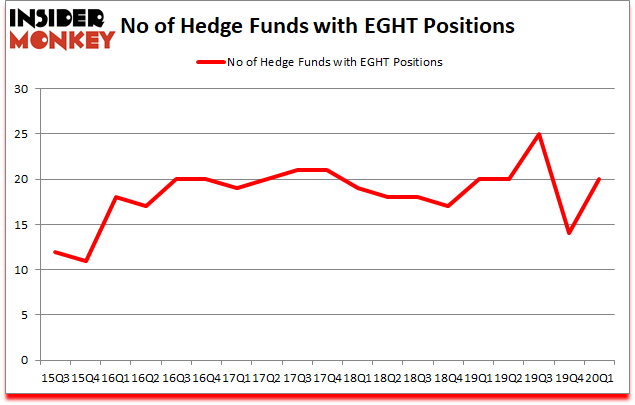

8×8, Inc. (NASDAQ:EGHT) shareholders have witnessed an increase in activity from the world’s largest hedge funds in recent months. EGHT was in 20 hedge funds’ portfolios at the end of the first quarter of 2020. There were 14 hedge funds in our database with EGHT positions at the end of the previous quarter. Our calculations also showed that EGHT isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are plenty of methods stock traders employ to size up publicly traded companies. Two of the less utilized methods are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the top money managers can outperform the market by a healthy amount (see the details here).

Chase Coleman of Tiger Global

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, 2020’s unprecedented market conditions provide us with the highest number of trading opportunities in a decade. So we are checking out trades like this one. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to review the recent hedge fund action encompassing 8×8, Inc. (NASDAQ:EGHT).

Hedge fund activity in 8×8, Inc. (NASDAQ:EGHT)

Heading into the second quarter of 2020, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 43% from the previous quarter. By comparison, 20 hedge funds held shares or bullish call options in EGHT a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Sylebra Capital Management, managed by Daniel Patrick Gibson, holds the number one position in 8×8, Inc. (NASDAQ:EGHT). Sylebra Capital Management has a $124.7 million position in the stock, comprising 5.1% of its 13F portfolio. The second most bullish fund manager is Tiger Global Management LLC, led by Chase Coleman, holding a $68.6 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions include Alok Agrawal’s Bloom Tree Partners, Ken Griffin’s Citadel Investment Group and Brian Ashford-Russell and Tim Woolley’s Polar Capital. In terms of the portfolio weights assigned to each position Sylebra Capital Management allocated the biggest weight to 8×8, Inc. (NASDAQ:EGHT), around 5.11% of its 13F portfolio. Bloom Tree Partners is also relatively very bullish on the stock, setting aside 5 percent of its 13F equity portfolio to EGHT.

As one would reasonably expect, specific money managers have been driving this bullishness. Bloom Tree Partners, managed by Alok Agrawal, established the biggest position in 8×8, Inc. (NASDAQ:EGHT). Bloom Tree Partners had $35.1 million invested in the company at the end of the quarter. Mark Coe’s Intrinsic Edge Capital also initiated a $14.7 million position during the quarter. The following funds were also among the new EGHT investors: Israel Englander’s Millennium Management, Paul Singer’s Elliott Investment Management, and Brandon Haley’s Holocene Advisors.

Let’s also examine hedge fund activity in other stocks similar to 8×8, Inc. (NASDAQ:EGHT). These stocks are NBT Bancorp Inc. (NASDAQ:NBTB), Domtar Corporation (NYSE:UFS), CareTrust REIT Inc (NASDAQ:CTRE), and Pacira Biosciences Inc (NASDAQ:PCRX). This group of stocks’ market caps are similar to EGHT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NBTB | 4 | 10462 | -3 |

| UFS | 18 | 86572 | -8 |

| CTRE | 7 | 19766 | -6 |

| PCRX | 26 | 368951 | -2 |

| Average | 13.75 | 121438 | -4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $121 million. That figure was $369 million in EGHT’s case. Pacira Biosciences Inc (NASDAQ:PCRX) is the most popular stock in this table. On the other hand NBT Bancorp Inc. (NASDAQ:NBTB) is the least popular one with only 4 bullish hedge fund positions. 8×8, Inc. (NASDAQ:EGHT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.2% in 2020 through June 17th but beat the market by 14.8 percentage points. Unfortunately EGHT wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on EGHT were disappointed as the stock returned 8.2% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow 8X8 Inc (NASDAQ:EGHT)

Follow 8X8 Inc (NASDAQ:EGHT)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.