Coronavirus is probably the #1 concern in investors’ minds right now. It should be. We estimate that COVID-19 will kill around 5 million people worldwide and there is a 3.3% probability that Donald Trump will die from the new coronavirus (read the details). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 835 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about United Airlines Holdings Inc (NYSE:UAL).

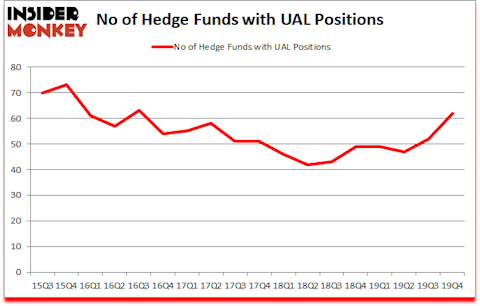

Is United Airlines Holdings Inc (NYSE:UAL) an excellent stock to buy now? Money managers were betting on the stock at the of 2019. The number of long hedge fund positions went up by 10 during Q4. Our calculations also showed that UAL isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings). UAL was in 62 hedge funds’ portfolios at the end of December. There were 52 hedge funds in our database with UAL positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Warren Buffett of Berkshire Hathaway

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. Keeping this in mind let’s take a gander at the latest hedge fund action regarding United Airlines Holdings Inc (NYSE:UAL).

How have hedgies been trading United Airlines Holdings Inc (NYSE:UAL)?

At Q4’s end, a total of 62 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 19% from the third quarter of 2019. The graph below displays the number of hedge funds with bullish position in UAL over the last 18 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Berkshire Hathaway, managed by Warren Buffett, holds the most valuable position in United Airlines Holdings Inc (NYSE:UAL). Berkshire Hathaway has a $1.9326 billion position in the stock, comprising 0.8% of its 13F portfolio. On Berkshire Hathaway’s heels is PAR Capital Management, managed by Paul Reeder and Edward Shapiro, which holds a $1.2418 billion position; 24.2% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions consist of Brad Gerstner’s Altimeter Capital Management, Cliff Asness’s AQR Capital Management and Alex Snow’s Lansdowne Partners. In terms of the portfolio weights assigned to each position PAR Capital Management allocated the biggest weight to United Airlines Holdings Inc (NYSE:UAL), around 24.16% of its 13F portfolio. Altimeter Capital Management is also relatively very bullish on the stock, earmarking 23.25 percent of its 13F equity portfolio to UAL.

With a general bullishness amongst the heavyweights, specific money managers have jumped into United Airlines Holdings Inc (NYSE:UAL) headfirst. Crake Asset Management, managed by Martin Taylor, initiated the most valuable position in United Airlines Holdings Inc (NYSE:UAL). Crake Asset Management had $59.8 million invested in the company at the end of the quarter. Jack Woodruff’s Candlestick Capital Management also initiated a $31.7 million position during the quarter. The other funds with brand new UAL positions are Dmitry Balyasny’s Balyasny Asset Management, Brandon Haley’s Holocene Advisors, and Gregg Moskowitz’s Interval Partners.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as United Airlines Holdings Inc (NYSE:UAL) but similarly valued. We will take a look at ResMed Inc. (NYSE:RMD), Dollar Tree, Inc. (NASDAQ:DLTR), American Water Works Company, Inc. (NYSE:AWK), and Fresenius Medical Care AG & Co. (NYSE:FMS). This group of stocks’ market valuations resemble UAL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RMD | 21 | 172399 | -2 |

| DLTR | 51 | 1620166 | -1 |

| AWK | 29 | 625913 | -11 |

| FMS | 11 | 13249 | 6 |

| Average | 28 | 607932 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $608 million. That figure was $6948 million in UAL’s case. Dollar Tree, Inc. (NASDAQ:DLTR) is the most popular stock in this table. On the other hand Fresenius Medical Care AG & Co. (NYSE:FMS) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks United Airlines Holdings Inc (NYSE:UAL) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 12.9% in 2020 through March 9th and still beat the market by 1.9 percentage points. Unfortunately UAL wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on UAL were disappointed as the stock returned -46.9% during the first two months of 2020 (through March 9th) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market in Q1.

Disclosure: None. This article was originally published at Insider Monkey.