Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The last 12 months is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Servicesource International Inc (NASDAQ:SREV).

Servicesource International Inc (NASDAQ:SREV) has experienced a decrease in activity from the world’s largest hedge funds recently. Our calculations also showed that SREV isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most traders, hedge funds are assumed to be worthless, old investment vehicles of years past. While there are more than 8000 funds in operation at the moment, We look at the crème de la crème of this club, around 750 funds. These money managers manage the majority of the hedge fund industry’s total capital, and by tracking their inimitable stock picks, Insider Monkey has found a few investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

J. Carlo Cannell of Cannell Capital

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to go over the key hedge fund action surrounding Servicesource International Inc (NASDAQ:SREV).

Hedge fund activity in Servicesource International Inc (NASDAQ:SREV)

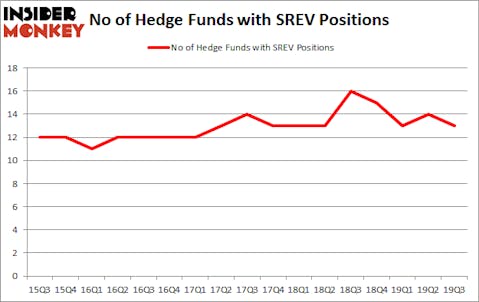

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from the previous quarter. On the other hand, there were a total of 16 hedge funds with a bullish position in SREV a year ago. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Archon Capital Management, managed by Constantinos J. Christofilis, holds the biggest position in Servicesource International Inc (NASDAQ:SREV). Archon Capital Management has a $7.4 million position in the stock, comprising 1.8% of its 13F portfolio. On Archon Capital Management’s heels is Cannell Capital, managed by J. Carlo Cannell, which holds a $5.8 million position; the fund has 1.9% of its 13F portfolio invested in the stock. Other peers with similar optimism consist of David Park’s Headlands Capital, Renaissance Technologies and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital. In terms of the portfolio weights assigned to each position Headlands Capital allocated the biggest weight to Servicesource International Inc (NASDAQ:SREV), around 3.4% of its 13F portfolio. Cannell Capital is also relatively very bullish on the stock, designating 1.89 percent of its 13F equity portfolio to SREV.

Judging by the fact that Servicesource International Inc (NASDAQ:SREV) has witnessed bearish sentiment from the aggregate hedge fund industry, logic holds that there was a specific group of hedgies that slashed their full holdings in the third quarter. It’s worth mentioning that Phil Frohlich’s Prescott Group Capital Management dumped the biggest position of the “upper crust” of funds monitored by Insider Monkey, worth about $1.6 million in stock. Paul Marshall and Ian Wace’s fund, Marshall Wace, also cut its stock, about $0.1 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by 1 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Servicesource International Inc (NASDAQ:SREV) but similarly valued. We will take a look at Gulf Island Fabrication, Inc. (NASDAQ:GIFI), Consumer Portfolio Services, Inc. (NASDAQ:CPSS), Lightinthebox Holding Co Ltd-ADR (NYSE:LITB), and Hennessy Advisors, Inc. (NASDAQ:HNNA). This group of stocks’ market caps are similar to SREV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GIFI | 11 | 14660 | 2 |

| CPSS | 1 | 1332 | 0 |

| LITB | 2 | 461 | 1 |

| HNNA | 3 | 2017 | 0 |

| Average | 4.25 | 4618 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.25 hedge funds with bullish positions and the average amount invested in these stocks was $5 million. That figure was $24 million in SREV’s case. Gulf Island Fabrication, Inc. (NASDAQ:GIFI) is the most popular stock in this table. On the other hand Consumer Portfolio Services, Inc. (NASDAQ:CPSS) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Servicesource International Inc (NASDAQ:SREV) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on SREV as the stock returned 73.9% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.