Hedge funds are known to underperform the bull markets but that’s not because they are bad at investing. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. Hedge funds underperform because they are hedged. The Standard and Poor’s 500 Index ETFs returned approximately 27.5% through the end of November (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 37.4% during the same period. An average long/short hedge fund returned only a fraction of this due to the hedges they implement and the large fees they charge. Our research covering the last 18 years indicates that investors can outperform the market by imitating hedge funds’ consensus stock picks rather than directly investing in hedge funds. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Proteostasis Therapeutics, Inc. (NASDAQ:PTI).

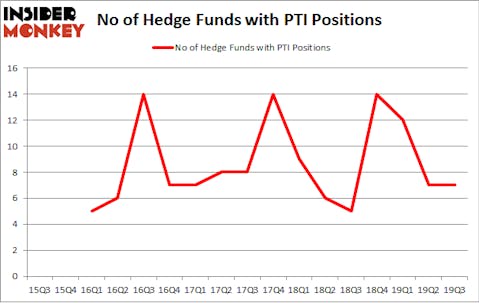

Proteostasis Therapeutics, Inc. (NASDAQ:PTI) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 7 hedge funds’ portfolios at the end of September. At the end of this article we will also compare PTI to other stocks including Francesca’s Holdings Corporation (NASDAQ:FRAN), iMedia Brands, Inc. (NASDAQ:IMBI), and Riot Blockchain, Inc (NASDAQ:RIOT) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

John Overdeck of Two Sigma Advisors

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the latest hedge fund action regarding Proteostasis Therapeutics, Inc. (NASDAQ:PTI).

How are hedge funds trading Proteostasis Therapeutics, Inc. (NASDAQ:PTI)?

At Q3’s end, a total of 7 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. By comparison, 5 hedge funds held shares or bullish call options in PTI a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Great Point Partners held the most valuable stake in Proteostasis Therapeutics, Inc. (NASDAQ:PTI), which was worth $3 million at the end of the third quarter. On the second spot was Rock Springs Capital Management which amassed $0.3 million worth of shares. Millennium Management, Citadel Investment Group, and Two Sigma Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Great Point Partners allocated the biggest weight to Proteostasis Therapeutics, Inc. (NASDAQ:PTI), around 0.27% of its 13F portfolio. Rock Springs Capital Management is also relatively very bullish on the stock, earmarking 0.01 percent of its 13F equity portfolio to PTI.

Judging by the fact that Proteostasis Therapeutics, Inc. (NASDAQ:PTI) has witnessed bearish sentiment from the aggregate hedge fund industry, logic holds that there lies a certain “tier” of hedgies that slashed their positions entirely last quarter. At the top of the heap, Donald Sussman’s Paloma Partners dumped the largest position of all the hedgies watched by Insider Monkey, totaling about $0.2 million in stock. David E. Shaw’s fund, D E Shaw, also sold off its stock, about $0 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Proteostasis Therapeutics, Inc. (NASDAQ:PTI) but similarly valued. We will take a look at Francesca’s Holdings Corp (NASDAQ:FRAN), iMedia Brands, Inc. (NASDAQ:IMBI), Riot Blockchain, Inc (NASDAQ:RIOT), and Deswell Industries, Inc. (NASDAQ:DSWL). This group of stocks’ market caps resemble PTI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FRAN | 8 | 6199 | 0 |

| IMBI | 4 | 2312 | 1 |

| RIOT | 1 | 117 | 0 |

| DSWL | 2 | 108 | 1 |

| Average | 3.75 | 2184 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.75 hedge funds with bullish positions and the average amount invested in these stocks was $2 million. That figure was $4 million in PTI’s case. Francesca’s Holdings Corp (NASDAQ:FRAN) is the most popular stock in this table. On the other hand Riot Blockchain, Inc (NASDAQ:RIOT) is the least popular one with only 1 bullish hedge fund positions. Proteostasis Therapeutics, Inc. (NASDAQ:PTI) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on PTI as the stock returned 188.8% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.