We are still in an overall bull market and many stocks that smart money investors were piling into surged through October 17th. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 45% and 39% respectively. Hedge funds’ top 3 stock picks returned 34.4% this year and beat the S&P 500 ETFs by 13 percentage points. That’s a big deal.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

Is Immunomedics, Inc. (NASDAQ:IMMU) a bargain? Money managers are in a bearish mood. The number of bullish hedge fund bets decreased by 3 recently. Our calculations also showed that IMMU isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most investors, hedge funds are perceived as worthless, old financial tools of yesteryear. While there are more than 8000 funds with their doors open at the moment, Our experts look at the crème de la crème of this club, about 750 funds. These investment experts oversee the lion’s share of the hedge fund industry’s total capital, and by tailing their highest performing picks, Insider Monkey has uncovered numerous investment strategies that have historically outrun Mr. Market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the new hedge fund action regarding Immunomedics, Inc. (NASDAQ:IMMU).

How are hedge funds trading Immunomedics, Inc. (NASDAQ:IMMU)?

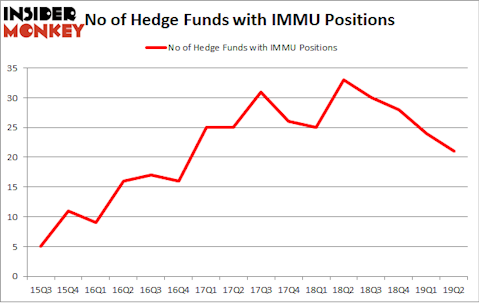

At Q2’s end, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -13% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in IMMU over the last 16 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

More specifically, venBio Select Advisor was the largest shareholder of Immunomedics, Inc. (NASDAQ:IMMU), with a stake worth $291.3 million reported as of the end of March. Trailing venBio Select Advisor was Palo Alto Investors, which amassed a stake valued at $92.6 million. Deerfield Management, Citadel Investment Group, and Alkeon Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that Immunomedics, Inc. (NASDAQ:IMMU) has faced bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there is a sect of money managers that decided to sell off their entire stakes heading into Q3. Interestingly, Matt Sirovich and Jeremy Mindich’s Scopia Capital sold off the biggest investment of the “upper crust” of funds followed by Insider Monkey, comprising about $37.2 million in stock, and Louis Bacon’s Moore Global Investments was right behind this move, as the fund said goodbye to about $7 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 3 funds heading into Q3.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Immunomedics, Inc. (NASDAQ:IMMU) but similarly valued. We will take a look at BlackLine, Inc. (NASDAQ:BL), Sotheby’s (NYSE:BID), PotlatchDeltic Corporation (NASDAQ:PCH), and Owens-Illinois Inc (NYSE:OI). This group of stocks’ market caps are similar to IMMU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BL | 15 | 94921 | -5 |

| BID | 20 | 739218 | 2 |

| PCH | 12 | 321079 | -5 |

| OI | 21 | 341003 | -2 |

| Average | 17 | 374055 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $374 million. That figure was $618 million in IMMU’s case. Owens-Illinois Inc (NYSE:OI) is the most popular stock in this table. On the other hand PotlatchDeltic Corporation (NASDAQ:PCH) is the least popular one with only 12 bullish hedge fund positions. Immunomedics, Inc. (NASDAQ:IMMU) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately IMMU wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on IMMU were disappointed as the stock returned -4.4% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.