We know that hedge funds generate strong, risk-adjusted returns over the long run, which is why imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, professional investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do. However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, let’s examine the smart money sentiment towards Qiagen NV (NASDAQ:QGEN) and determine whether hedge funds skillfully traded this stock.

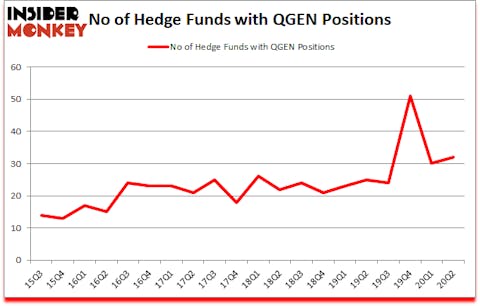

Is Qiagen NV (NASDAQ:QGEN) a worthy stock to buy now? Investors who are in the know were becoming hopeful. The number of long hedge fund positions went up by 2 lately. Qiagen NV (NASDAQ:QGEN) was in 32 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 51. Our calculations also showed that QGEN isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks). There were 30 hedge funds in our database with QGEN positions at the end of the first quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

To most stock holders, hedge funds are viewed as worthless, old financial tools of the past. While there are over 8000 funds with their doors open at present, Our researchers look at the crème de la crème of this club, approximately 850 funds. It is estimated that this group of investors administer the lion’s share of all hedge funds’ total asset base, and by tracking their top stock picks, Insider Monkey has found many investment strategies that have historically outperformed the broader indices. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 34% since February 2017 (through August 17th) even though the market was up 53% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, this “mom” trader turned $2000 into $2 million within 2 years. So, we are checking out her best trade idea of the month. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind let’s take a look at the recent hedge fund action surrounding Qiagen NV (NASDAQ:QGEN).

Hedge fund activity in Qiagen NV (NASDAQ:QGEN)

At Q2’s end, a total of 32 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 7% from the first quarter of 2020. By comparison, 25 hedge funds held shares or bullish call options in QGEN a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Farallon Capital, holds the biggest position in Qiagen NV (NASDAQ:QGEN). Farallon Capital has a $123.3 million position in the stock, comprising 1% of its 13F portfolio. Coming in second is Magnetar Capital, led by Alec Litowitz and Ross Laser, holding a $96.8 million position; 2.9% of its 13F portfolio is allocated to the company. Some other members of the smart money that hold long positions contain Dmitry Balyasny’s Balyasny Asset Management, Israel Englander’s Millennium Management and Ken Griffin’s Citadel Investment Group. In terms of the portfolio weights assigned to each position Magnetar Capital allocated the biggest weight to Qiagen NV (NASDAQ:QGEN), around 2.85% of its 13F portfolio. Water Island Capital is also relatively very bullish on the stock, designating 1.71 percent of its 13F equity portfolio to QGEN.

As aggregate interest increased, some big names were breaking ground themselves. Farallon Capital, created the largest position in Qiagen NV (NASDAQ:QGEN). Farallon Capital had $123.3 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $27.4 million investment in the stock during the quarter. The following funds were also among the new QGEN investors: John Paulson’s Paulson & Co, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, and Michel Massoud’s Melqart Asset Management.

Let’s now take a look at hedge fund activity in other stocks similar to Qiagen NV (NASDAQ:QGEN). We will take a look at China Southern Airlines Co Ltd (NYSE:ZNH), RPM International Inc. (NYSE:RPM), Carlyle Group LP (NASDAQ:CG), Magellan Midstream Partners, L.P. (NYSE:MMP), ASE Technology Holding Co., Ltd. (NYSE:ASX), DENTSPLY SIRONA Inc. (NASDAQ:XRAY), and Loews Corporation (NYSE:L). This group of stocks’ market caps are similar to QGEN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZNH | 2 | 7852 | 0 |

| RPM | 26 | 108615 | 4 |

| CG | 8 | 171536 | -8 |

| MMP | 15 | 59070 | 2 |

| ASX | 11 | 167226 | 2 |

| XRAY | 28 | 1023314 | -2 |

| L | 28 | 153092 | 7 |

| Average | 16.9 | 241529 | 0.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.9 hedge funds with bullish positions and the average amount invested in these stocks was $242 million. That figure was $652 million in QGEN’s case. DENTSPLY SIRONA Inc. (NASDAQ:XRAY) is the most popular stock in this table. On the other hand China Southern Airlines Co Ltd (NYSE:ZNH) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Qiagen NV (NASDAQ:QGEN) is more popular among hedge funds. Our overall hedge fund sentiment score for QGEN is 75.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 23.8% in 2020 through September 14th but still managed to beat the market by 17.6 percentage points. Hedge funds were also right about betting on QGEN as the stock returned 16.8% since the end of June and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Qiagen Nv (NYSE:QGEN)

Follow Qiagen Nv (NYSE:QGEN)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.