Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow nearly 900 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is The Walt Disney Company (NYSE:DIS), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

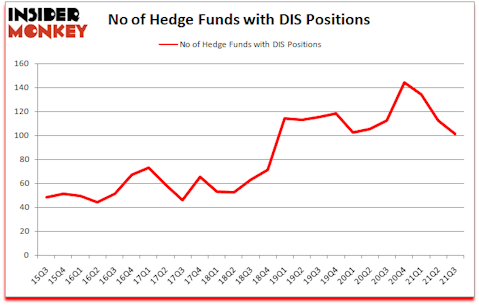

The Walt Disney Company (NYSE:DIS) was in 101 hedge funds’ portfolios at the end of September. The all time high for this statistic is 144. DIS investors should be aware of a decrease in hedge fund interest of late. There were 112 hedge funds in our database with DIS positions at the end of the second quarter. Our calculations also showed that DIS ranked 16th among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind let’s take a gander at the key hedge fund action surrounding The Walt Disney Company (NYSE:DIS).

Dan Loeb of Third Point

Do Hedge Funds Think DIS Is A Good Stock To Buy Now?

At Q3’s end, a total of 101 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -10% from the second quarter of 2021. Below, you can check out the change in hedge fund sentiment towards DIS over the last 25 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

Among these funds, Fisher Asset Management held the most valuable stake in The Walt Disney Company (NYSE:DIS), which was worth $1878.7 million at the end of the third quarter. On the second spot was Coatue Management which amassed $989.7 million worth of shares. Matrix Capital Management, Third Point, and Eagle Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Fosse Capital Partners allocated the biggest weight to The Walt Disney Company (NYSE:DIS), around 22.05% of its 13F portfolio. Crake Asset Management is also relatively very bullish on the stock, dishing out 14.07 percent of its 13F equity portfolio to DIS.

Seeing as The Walt Disney Company (NYSE:DIS) has experienced declining sentiment from the aggregate hedge fund industry, logic holds that there lies a certain “tier” of money managers who sold off their full holdings heading into Q4. Interestingly, Matthew Stadelman’s Diamond Hill Capital cut the biggest investment of the “upper crust” of funds tracked by Insider Monkey, totaling an estimated $653.5 million in stock, and Renaissance Technologies was right behind this move, as the fund dropped about $310.8 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 11 funds heading into Q4.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as The Walt Disney Company (NYSE:DIS) but similarly valued. These stocks are Paypal Holdings Inc (NASDAQ:PYPL), Adobe Inc. (NASDAQ:ADBE), Netflix, Inc. (NASDAQ:NFLX), salesforce.com, inc. (NYSE:CRM), Comcast Corporation (NASDAQ:CMCSA), Royal Dutch Shell plc (NYSE:RDS), and Exxon Mobil Corporation (NYSE:XOM). This group of stocks’ market valuations are closest to DIS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PYPL | 123 | 12880990 | -20 |

| ADBE | 95 | 12682168 | 6 |

| NFLX | 106 | 14759355 | -7 |

| CRM | 119 | 14900848 | 11 |

| CMCSA | 75 | 8547154 | -9 |

| RDS | 33 | 2053904 | -5 |

| XOM | 64 | 4640444 | -4 |

| Average | 87.9 | 10066409 | -4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 87.9 hedge funds with bullish positions and the average amount invested in these stocks was $10066 million. That figure was $9416 million in DIS’s case. Paypal Holdings Inc (NASDAQ:PYPL) is the most popular stock in this table. On the other hand Royal Dutch Shell plc (NYSE:RDS) is the least popular one with only 33 bullish hedge fund positions. The Walt Disney Company (NYSE:DIS) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for DIS is 73.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.6% in 2021 through November 30th and beat the market again by 5.6 percentage points. Unfortunately DIS wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on DIS were disappointed as the stock returned -14.3% since the end of September (through 11/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Walt Disney Co (NYSE:DIS)

Follow Walt Disney Co (NYSE:DIS)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Hedge Funds that Profited from Reddit’s Meme Stock Craze

- 10 Best Advertising Stocks To Buy Now

- 15 Most Valuable Weed Companies in the World

Disclosure: None. This article was originally published at Insider Monkey.