At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (see why hell is coming). We reversed our stance on March 25th after seeing unprecedented fiscal and monetary stimulus unleashed by the Fed and the Congress. This is the perfect market for stock pickers, now that the stocks are fully valued again. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Carvana Co. (NYSE:CVNA) at the end of the second quarter and determine whether the smart money was really smart about this stock.

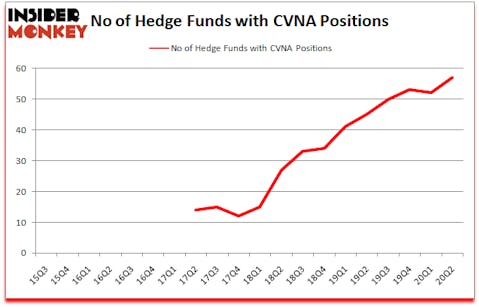

Is Carvana Co. (NYSE:CVNA) an exceptional investment right now? Money managers were taking an optimistic view. The number of bullish hedge fund positions went up by 5 in recent months. Carvana Co. (NYSE:CVNA) was in 57 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 53. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that CVNA isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are numerous tools stock market investors use to grade their stock investments. Some of the most under-the-radar tools are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the elite investment managers can outpace the market by a superb margin (see the details here).

Daniel Sundheim of D1 Capital Partners

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost precious metals prices. So, we are checking out this junior gold mining stock.. We go through lists like the 10 most profitable companies in America to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. With all of this in mind let’s take a look at the new hedge fund action surrounding Carvana Co. (NYSE:CVNA).

Hedge fund activity in Carvana Co. (NYSE:CVNA)

At the end of June, a total of 57 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 10% from the first quarter of 2020. Below, you can check out the change in hedge fund sentiment towards CVNA over the last 20 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Tiger Global Management LLC, managed by Chase Coleman, holds the largest position in Carvana Co. (NYSE:CVNA). Tiger Global Management LLC has a $722.8 million position in the stock, comprising 2.8% of its 13F portfolio. The second largest stake is held by Zachary Sternberg and Benjamin Stein of Spruce House Investment Management, with a $519.5 million position; the fund has 7% of its 13F portfolio invested in the stock. Some other professional money managers with similar optimism include Clifford A. Sosin’s CAS Investment Partners, Alex Sacerdote’s Whale Rock Capital Management and D. E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position CAS Investment Partners allocated the biggest weight to Carvana Co. (NYSE:CVNA), around 48.85% of its 13F portfolio. Goodnow Investment Group is also relatively very bullish on the stock, designating 23.01 percent of its 13F equity portfolio to CVNA.

As one would reasonably expect, some big names were breaking ground themselves. D1 Capital Partners, managed by Daniel Sundheim, initiated the biggest position in Carvana Co. (NYSE:CVNA). D1 Capital Partners had $124.4 million invested in the company at the end of the quarter. John Smith Clark’s Southpoint Capital Advisors also made a $84.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Aaron Cowen’s Suvretta Capital Management, Jack Woodruff’s Candlestick Capital Management, and Brad Stephens’s Six Columns Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Carvana Co. (NYSE:CVNA). These stocks are Alexandria Real Estate Equities Inc (NYSE:ARE), Realty Income Corporation (NYSE:O), Hilton Worldwide Holdings Inc (NYSE:HLT), Rogers Communications Inc. (NYSE:RCI), D.R. Horton, Inc. (NYSE:DHI), Southwest Airlines Co. (NYSE:LUV), and Corteva, Inc. (NYSE:CTVA). This group of stocks’ market values resemble CVNA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARE | 18 | 53382 | -11 |

| O | 17 | 185310 | -8 |

| HLT | 53 | 4467377 | 10 |

| RCI | 16 | 340545 | 0 |

| DHI | 66 | 2088308 | 1 |

| LUV | 56 | 873793 | 11 |

| CTVA | 39 | 775291 | 3 |

| Average | 37.9 | 1254858 | 0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 37.9 hedge funds with bullish positions and the average amount invested in these stocks was $1255 million. That figure was $3588 million in CVNA’s case. D.R. Horton, Inc. (NYSE:DHI) is the most popular stock in this table. On the other hand Rogers Communications Inc. (NYSE:RCI) is the least popular one with only 16 bullish hedge fund positions. Carvana Co. (NYSE:CVNA) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for CVNA is 81. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 28.2% in 2020 through August 24th but still beat the market by 20.6 percentage points. Hedge funds were also right about betting on CVNA as the stock returned 67.1% since Q2 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Carvana Co. (NYSE:CVNA)

Follow Carvana Co. (NYSE:CVNA)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.