The first quarter was a breeze as Powell pivoted, and China seemed eager to reach a deal with Trump. Both the S&P 500 and Russell 2000 delivered very strong gains as a result, with the Russell 2000, which is composed of smaller companies, outperforming the large-cap stocks slightly during the first quarter. Unfortunately sentiment shifted in May and August as this time China pivoted and Trump put more pressure on China by increasing tariffs. Fourth quarter brought optimism to the markets and hedge funds’ top 20 stock picks performed spectacularly in this volatile environment. These stocks delivered a total gain of 37.4% through the end of November, vs. a gain of 27.5% for the S&P 500 ETF. In this article we will look at how this market volatility affected the sentiment of hedge funds towards TransUnion (NYSE:TRU), and what that likely means for the prospects of the company and its stock.

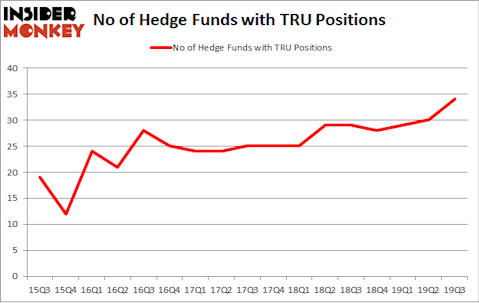

Is TransUnion (NYSE:TRU) a buy here? The best stock pickers are becoming more confident. The number of bullish hedge fund positions inched up by 4 in recent months. Our calculations also showed that TRU isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are numerous tools stock traders have at their disposal to analyze publicly traded companies. A couple of the less utilized tools are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the top picks of the best fund managers can outclass the S&P 500 by a solid margin (see the details here).

Paul Marshall of Marshall Wace

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a glance at the recent hedge fund action regarding TransUnion (NYSE:TRU).

What does smart money think about TransUnion (NYSE:TRU)?

At Q3’s end, a total of 34 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in TRU over the last 17 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

Among these funds, Citadel Investment Group held the most valuable stake in TransUnion (NYSE:TRU), which was worth $226.9 million at the end of the third quarter. On the second spot was BlueSpruce Investments which amassed $132.6 million worth of shares. D E Shaw, Farallon Capital, and Marshall Wace were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Lansing Management allocated the biggest weight to TransUnion (NYSE:TRU), around 17.48% of its portfolio. Bodenholm Capital is also relatively very bullish on the stock, earmarking 12 percent of its 13F equity portfolio to TRU.

As industrywide interest jumped, key money managers have been driving this bullishness. Columbus Circle Investors, managed by Principal Global Investors, established the most outsized position in TransUnion (NYSE:TRU). Columbus Circle Investors had $32 million invested in the company at the end of the quarter. Philippe Laffont’s Coatue Management also initiated a $9.5 million position during the quarter. The following funds were also among the new TRU investors: Joel Greenblatt’s Gotham Asset Management, Donald Sussman’s Paloma Partners, and Lee Ainslie’s Maverick Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as TransUnion (NYSE:TRU) but similarly valued. These stocks are PagSeguro Digital Ltd. (NYSE:PAGS), CenterPoint Energy, Inc. (NYSE:CNP), Magellan Midstream Partners, L.P. (NYSE:MMP), and Celanese Corporation (NYSE:CE). This group of stocks’ market caps resemble TRU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PAGS | 35 | 1381252 | 5 |

| CNP | 27 | 1089888 | -2 |

| MMP | 12 | 55553 | 2 |

| CE | 18 | 944524 | -2 |

| Average | 23 | 867804 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $868 million. That figure was $1041 million in TRU’s case. PagSeguro Digital Ltd. (NYSE:PAGS) is the most popular stock in this table. On the other hand Magellan Midstream Partners, L.P. (NYSE:MMP) is the least popular one with only 12 bullish hedge fund positions. TransUnion (NYSE:TRU) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on TRU, though not to the same extent, as the stock returned 6.5% during the first two months of the fourth quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.