The Insider Monkey team has completed processing the quarterly 13F filings for the December quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Willis Towers Watson Public Limited Company (NASDAQ:WLTW).

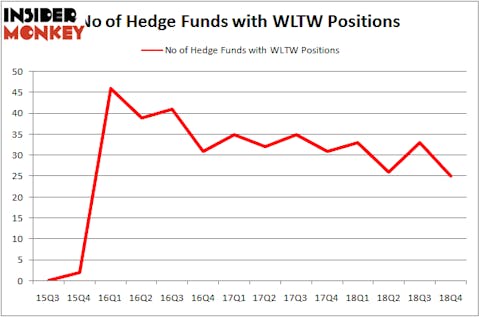

Willis Towers Watson Public Limited Company (NASDAQ:WLTW) investors should be aware of a decrease in support from the world’s most elite money managers in recent months. WLTW was in 25 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 33 hedge funds in our database with WLTW positions at the end of the previous quarter. Our calculations also showed that WLTW isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a gander at the latest hedge fund action encompassing Willis Towers Watson Public Limited Company (NASDAQ:WLTW).

What have hedge funds been doing with Willis Towers Watson Public Limited Company (NASDAQ:WLTW)?

At Q4’s end, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -24% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in WLTW over the last 14 quarters. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Cantillon Capital Management, managed by William von Mueffling, holds the most valuable position in Willis Towers Watson Public Limited Company (NASDAQ:WLTW). Cantillon Capital Management has a $375.7 million position in the stock, comprising 4.5% of its 13F portfolio. The second most bullish fund manager is Balyasny Asset Management, led by Dmitry Balyasny, holding a $169.6 million position; the fund has 1.2% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors with similar optimism encompass David Abrams’s Abrams Capital Management, Richard S. Pzena’s Pzena Investment Management and Ric Dillon’s Diamond Hill Capital.

Due to the fact that Willis Towers Watson Public Limited Company (NASDAQ:WLTW) has faced falling interest from hedge fund managers, it’s safe to say that there exists a select few hedge funds that decided to sell off their full holdings heading into Q3. Intriguingly, Alex Duran and Scott Hendrickson’s Permian Investment Partners said goodbye to the largest investment of the 700 funds monitored by Insider Monkey, worth close to $63.1 million in stock, and Alok Agrawal’s Bloom Tree Partners was right behind this move, as the fund dropped about $39.5 million worth. These moves are important to note, as total hedge fund interest fell by 8 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks similar to Willis Towers Watson Public Limited Company (NASDAQ:WLTW). We will take a look at The Clorox Company (NYSE:CLX), Waste Connections, Inc. (NYSE:WCN), Tyson Foods, Inc. (NYSE:TSN), and FirstEnergy Corp. (NYSE:FE). This group of stocks’ market caps are similar to WLTW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CLX | 28 | 1026937 | 6 |

| WCN | 28 | 677487 | -2 |

| TSN | 38 | 1426064 | -1 |

| FE | 39 | 3732180 | 1 |

| Average | 33.25 | 1715667 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.25 hedge funds with bullish positions and the average amount invested in these stocks was $1716 million. That figure was $1442 million in WLTW’s case. FirstEnergy Corp. (NYSE:FE) is the most popular stock in this table. On the other hand The Clorox Company (NYSE:CLX) is the least popular one with only 28 bullish hedge fund positions. Compared to these stocks Willis Towers Watson Public Limited Company (NASDAQ:WLTW) is even less popular than CLX. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on WLTW, though not to the same extent, as the stock returned 14.3% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.