You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

WEX Inc (NYSE:WEX) has experienced a decrease in enthusiasm from smart money in recent months. WEX was in 10 hedge funds’ portfolios at the end of September. There were 11 hedge funds in our database with WEX positions at the end of the previous quarter. At the end of this article we will also compare WEX to other stocks including Panera Bread Co (NASDAQ:PNRA), United Microelectronics Corp (ADR) (NYSE:UMC), and National Fuel Gas Co. (NYSE:NFG) to get a better sense of its popularity.

Follow Wex Inc. (NYSE:WEX)

Follow Wex Inc. (NYSE:WEX)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

bluebay/Shutterstock.com

What have hedge funds been doing with WEX Inc (NYSE:WEX)?

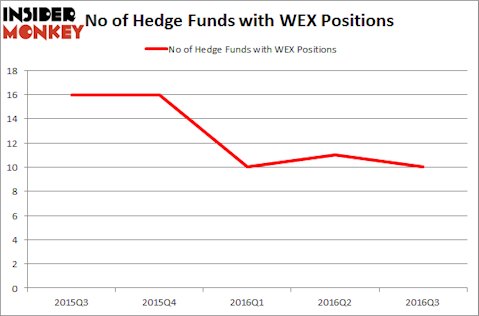

Heading into the fourth quarter of 2016, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 9% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in WEX over the last 5 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Mariko Gordon’s Daruma Asset Management has the largest position in WEX Inc (NYSE:WEX), worth close to $59.4 million, amounting to 3.6% of its total 13F portfolio. The second most bullish fund manager is PAR Capital Management, led by Paul Reeder and Edward Shapiro, holding a $47 million position. Some other members of the smart money with similar optimism include Steve Cohen’s Point72 Asset Management, Paul Tudor Jones’ Tudor Investment Corp and Joel Greenblatt’s Gotham Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.