With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the second quarter. One of these stocks was The Manitowoc Company, Inc. (NYSE:MTW).

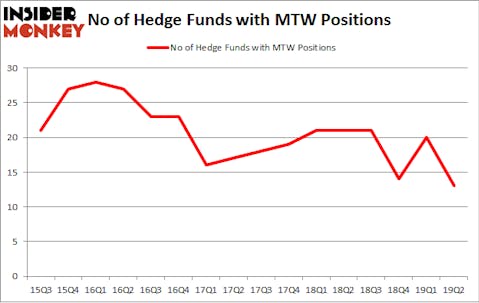

The Manitowoc Company, Inc. (NYSE:MTW) investors should be aware of a decrease in support from the world’s most elite money managers of late. MTW was in 13 hedge funds’ portfolios at the end of June. There were 20 hedge funds in our database with MTW positions at the end of the previous quarter. Our calculations also showed that MTW isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a large number of metrics stock traders put to use to assess stocks. Some of the most under-the-radar metrics are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the top investment managers can outclass the S&P 500 by a significant amount (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the latest hedge fund action regarding The Manitowoc Company, Inc. (NYSE:MTW).

What have hedge funds been doing with The Manitowoc Company, Inc. (NYSE:MTW)?

At the end of the second quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -35% from one quarter earlier. By comparison, 21 hedge funds held shares or bullish call options in MTW a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Firefly Value Partners, managed by Ryan Heslop and Ariel Warszawski, holds the number one position in The Manitowoc Company, Inc. (NYSE:MTW). Firefly Value Partners has a $62.7 million position in the stock, comprising 7.4% of its 13F portfolio. Sitting at the No. 2 spot is Peter Schliemann of Rutabaga Capital Management, with a $11.8 million position; the fund has 3.4% of its 13F portfolio invested in the stock. Some other professional money managers that hold long positions include David Brown’s Hawk Ridge Management, Ken Griffin’s Citadel Investment Group and Clint Murray’s Lodge Hill Capital.

Due to the fact that The Manitowoc Company, Inc. (NYSE:MTW) has experienced falling interest from the entirety of the hedge funds we track, logic holds that there was a specific group of hedgies who sold off their positions entirely heading into Q3. Interestingly, Paul Marshall and Ian Wace’s Marshall Wace LLP dumped the largest position of the “upper crust” of funds followed by Insider Monkey, worth about $6 million in stock. Steve Cohen’s fund, Point72 Asset Management, also dropped its stock, about $4 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by 7 funds heading into Q3.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as The Manitowoc Company, Inc. (NYSE:MTW) but similarly valued. These stocks are Stemline Therapeutics Inc (NASDAQ:STML), TherapeuticsMD Inc (NASDAQ:TXMD), FTS International, Inc. (NYSE:FTSI), and Quanex Building Products Corporation (NYSE:NX). All of these stocks’ market caps are similar to MTW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STML | 17 | 226395 | -3 |

| TXMD | 8 | 21158 | -1 |

| FTSI | 18 | 27543 | -3 |

| NX | 13 | 51317 | -3 |

| Average | 14 | 81603 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $82 million. That figure was $110 million in MTW’s case. FTS International, Inc. (NYSE:FTSI) is the most popular stock in this table. On the other hand TherapeuticsMD Inc (NASDAQ:TXMD) is the least popular one with only 8 bullish hedge fund positions. The Manitowoc Company, Inc. (NYSE:MTW) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately MTW wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); MTW investors were disappointed as the stock returned -29.8% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.