While the market driven by short-term sentiment influenced by uncertainty regarding the future of the interest rate environment in the US, declining oil prices and the trade war with China, many smart money investors are keeping their optimism regarding the current bull run, while still hedging many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Sleep Number Corporation (NASDAQ:SNBR).

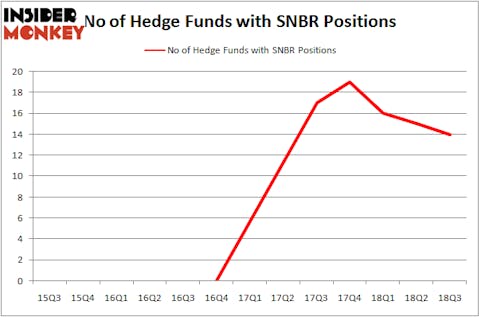

Sleep Number Corporation (NASDAQ:SNBR) has experienced a decrease in enthusiasm from smart money lately. SNBR was in 14 hedge funds’ portfolios at the end of the third quarter of 2018. There were 15 hedge funds in our database with SNBR positions at the end of the previous quarter. Our calculations also showed that SNBR isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most investors, hedge funds are viewed as slow, outdated investment vehicles of the past. While there are more than 8,000 funds with their doors open today, Our experts choose to focus on the masters of this group, about 700 funds. Most estimates calculate that this group of people direct bulk of all hedge funds’ total capital, and by paying attention to their matchless investments, Insider Monkey has determined a few investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a peek at the new hedge fund action surrounding Sleep Number Corporation (NASDAQ:SNBR).

What have hedge funds been doing with Sleep Number Corporation (NASDAQ:SNBR)?

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -7% from one quarter earlier. By comparison, 19 hedge funds held shares or bullish call options in SNBR heading into this year. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

Among these funds, GLG Partners held the most valuable stake in Sleep Number Corporation (NASDAQ:SNBR), which was worth $19.3 million at the end of the third quarter. On the second spot was D E Shaw which amassed $17.7 million worth of shares. Moreover, Point72 Asset Management, Two Sigma Advisors, and Citadel Investment Group were also bullish on Sleep Number Corporation (NASDAQ:SNBR), allocating a large percentage of their portfolios to this stock.

Due to the fact that Sleep Number Corporation (NASDAQ:SNBR) has experienced bearish sentiment from hedge fund managers, it’s safe to say that there was a specific group of fund managers who sold off their full holdings last quarter. It’s worth mentioning that Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital cut the biggest investment of the 700 funds tracked by Insider Monkey, worth an estimated $13.9 million in stock, and Ira Unschuld’s Brant Point Investment Management was right behind this move, as the fund dropped about $1.3 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 1 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Sleep Number Corporation (NASDAQ:SNBR). We will take a look at Tricida, Inc. (NASDAQ:TCDA), Air Transport Services Group Inc. (NASDAQ:ATSG), Beneficial Mutual Bancorp Inc (NASDAQ:BNCL), and Casa Systems, Inc. (NASDAQ:CASA). All of these stocks’ market caps match SNBR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TCDA | 15 | 510985 | 0 |

| ATSG | 20 | 232229 | -2 |

| BNCL | 9 | 95416 | -3 |

| CASA | 10 | 29535 | -2 |

| Average | 13.5 | 217041 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $217 million. That figure was $69 million in SNBR’s case. Air Transport Services Group Inc. (NASDAQ:ATSG) is the most popular stock in this table. On the other hand Beneficial Mutual Bancorp Inc (NASDAQ:BNCL) is the least popular one with only 9 bullish hedge fund positions. Sleep Number Corporation (NASDAQ:SNBR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ATSG might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.