Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Silver Bay Realty Trust Corp (NYSE:SBY).

Silver Bay Realty Trust Corp (NYSE:SBY) was in 13 hedge funds’ portfolios at the end of the third quarter of 2016. SBY investors should pay attention to a decrease in support from the world’s most successful money managers in recent months. There were 14 hedge funds in our database with SBY holdings at the end of the previous quarter. At the end of this article we will also compare SBY to other stocks including Univest Corp. of PA (NASDAQ:UVSP), Double Eagle Acqusition Corp (NASDAQ:EAGL), and Westlake Chemical Partners LP (NYSE:WLKP) to get a better sense of its popularity.

Follow Silver Bay Realty Trust Corp. (NYSE:SBY)

Follow Silver Bay Realty Trust Corp. (NYSE:SBY)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Aleksandr Bagri/Shutterstock.com

Keeping this in mind, we’re going to take a look at the recent action surrounding Silver Bay Realty Trust Corp (NYSE:SBY).

What have hedge funds been doing with Silver Bay Realty Trust Corp (NYSE:SBY)?

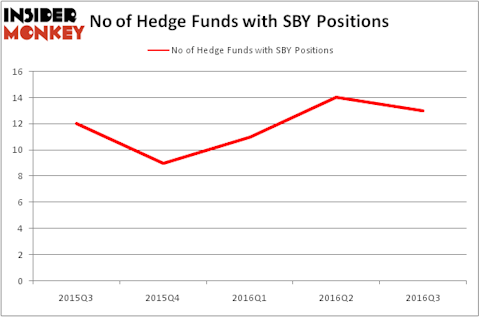

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, down by 7% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SBY over the last 5 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Renaissance Technologies holds the number one position in Silver Bay Realty Trust Corp (NYSE:SBY). Renaissance Technologies has a $45.7 million position in the stock, comprising 0.1% of its 13F portfolio. On Renaissance Technologies’ heels is Capital Growth Management, led by Ken Heebner, which holds a $27.6 million position; the fund has 1.3% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism consist of Greg Poole’s Echo Street Capital Management, Dmitry Balyasny’s Balyasny Asset Management and Cliff Asness’ AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.