Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Oceaneering International, Inc. (NYSE:OII) from the perspective of those elite funds.

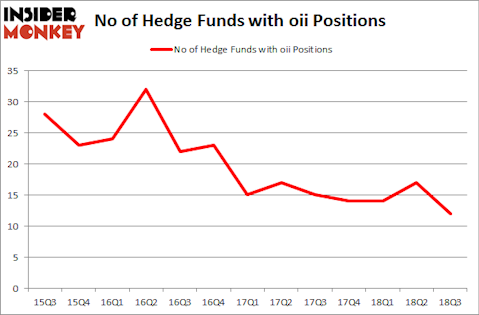

Oceaneering International, Inc. (NYSE:OII) has seen a decrease in support from the world’s most elite money managers recently. OII was in 12 hedge funds’ portfolios at the end of September. There were 17 hedge funds in our database with OII holdings at the end of the previous quarter. Our calculations also showed that oii isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most traders, hedge funds are assumed to be underperforming, old financial vehicles of yesteryear. While there are greater than 8,000 funds in operation at present, Our researchers choose to focus on the moguls of this group, around 700 funds. Most estimates calculate that this group of people administer bulk of the hedge fund industry’s total capital, and by paying attention to their best picks, Insider Monkey has uncovered a number of investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to go over the latest hedge fund action surrounding Oceaneering International, Inc. (NYSE:OII).

How have hedgies been trading Oceaneering International, Inc. (NYSE:OII)?

Heading into the fourth quarter of 2018, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -29% from the previous quarter. The graph below displays the number of hedge funds with bullish position in OII over the last 13 quarters. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

More specifically, Fisher Asset Management was the largest shareholder of Oceaneering International, Inc. (NYSE:OII), with a stake worth $84.1 million reported as of the end of September. Trailing Fisher Asset Management was AQR Capital Management, which amassed a stake valued at $67.8 million. Citadel Investment Group, Water Island Capital, and GAMCO Investors were also very fond of the stock, giving the stock large weights in their portfolios.

Because Oceaneering International, Inc. (NYSE:OII) has experienced declining sentiment from hedge fund managers, it’s safe to say that there were a few fund managers who sold off their entire stakes last quarter. At the top of the heap, Israel Englander’s Millennium Management cut the largest investment of the 700 funds tracked by Insider Monkey, valued at about $65.2 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also sold off its stock, about $38.9 million worth. These transactions are interesting, as total hedge fund interest fell by 5 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to Oceaneering International, Inc. (NYSE:OII). We will take a look at Simmons First National Corporation (NASDAQ:SFNC), Deluxe Corporation (NYSE:DLX), Industrias Bachoco, S.A.B. de C.V. (NYSE:IBA), and Rogers Corporation (NYSE:ROG). This group of stocks’ market valuations are closest to OII’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SFNC | 9 | 5177 | -1 |

| DLX | 21 | 109530 | 1 |

| IBA | 3 | 46788 | 0 |

| ROG | 7 | 52427 | -7 |

| Average | 10 | 53481 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $53 million. That figure was $226 million in OII’s case. Deluxe Corporation (NYSE:DLX) is the most popular stock in this table. On the other hand Industrias Bachoco, S.A.B. de C.V. (NYSE:IBA) is the least popular one with only 3 bullish hedge fund positions. Oceaneering International, Inc. (NYSE:OII) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard DLX might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.