The elite funds run by legendary investors such as David Tepper and Dan Loeb make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentives to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at News Corp (NASDAQ:NWS) from the perspective of those elite funds.

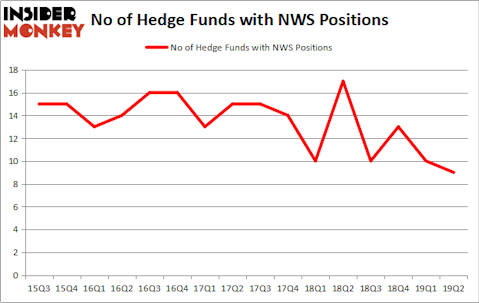

News Corp (NASDAQ:NWS) shareholders have witnessed a decrease in activity from the world’s largest hedge funds of late. Our calculations also showed that NWS isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s analyze the key hedge fund action regarding News Corp (NASDAQ:NWS).

What have hedge funds been doing with News Corp (NASDAQ:NWS)?

At Q2’s end, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of -10% from the previous quarter. By comparison, 17 hedge funds held shares or bullish call options in NWS a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Renaissance Technologies has the number one position in News Corp (NASDAQ:NWS), worth close to $11.1 million, accounting for less than 0.1%% of its total 13F portfolio. On Renaissance Technologies’s heels is Douglas Dossey and Arthur Young of Tensile Capital, with a $10.6 million position; the fund has 1.4% of its 13F portfolio invested in the stock. Remaining peers that hold long positions include Michael Hintze’s CQS Cayman LP, Mario Gabelli’s GAMCO Investors and Ken Griffin’s Citadel Investment Group.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: PEAK6 Capital Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 750+ hedge funds tracked by Insider Monkey identified NWS as a viable investment and initiated a position in the stock.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as News Corp (NASDAQ:NWS) but similarly valued. We will take a look at Spirit AeroSystems Holdings, Inc. (NYSE:SPR), Nielsen Holdings plc (NYSE:NLSN), Oaktree Capital Group LLC (NYSE:OAK), and Lamar Advertising Co (NASDAQ:LAMR). This group of stocks’ market values resemble NWS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SPR | 31 | 2042908 | 2 |

| NLSN | 35 | 1457332 | 2 |

| OAK | 17 | 145509 | 2 |

| LAMR | 24 | 242953 | 4 |

| Average | 26.75 | 972176 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.75 hedge funds with bullish positions and the average amount invested in these stocks was $972 million. That figure was $40 million in NWS’s case. Nielsen Holdings plc (NYSE:NLSN) is the most popular stock in this table. On the other hand Oaktree Capital Group LLC (NYSE:OAK) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks News Corp (NASDAQ:NWS) is even less popular than OAK. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on NWS, though not to the same extent, as the stock returned 3.1% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.